Here Are 8 Apps Like MoneyLion That Will Give You a Cash Advance

Posted on November 11, 2022 in Money

It can be difficult to choose a MoneyLion alternative, but hopefully by the end of this article, one of the 12 other cash advance apps like MoneyLion will make more sense for your specific financial situation.

Table of contents

- What is MoneyLion?

- What are the Pros and Cons of Using MoneyLion?

- What is Instacash by MoneyLion?

- What Are Some of the Best Cash Advance Apps Like MoneyLion?

- What is the Difference Between an Online Cash Advance App and an Online Banking App?

- How Quickly Will I Get My Cash Advance With an App Like MoneyLion?

- Why Are Loan Apps Like MoneyLion Better Than Payday Loans?

Are you living paycheck to paycheck these days, the way many of us are? If that is the case, you might be having trouble with your cash flow. While you may consider taking out a payday loan to make ends meet, that is not the best choice. A cash advance app is a safer, easier solution to your short term money woes, especially one like MoneyLion. In this blog post we will explore how MoneyLion can get you the cash you need fast while saving on interest and fees, as well as showing you some alternative options. Let’s get started!

What is MoneyLion?

MoneyLion is one of the most popular cash advance apps around. It is a fee-free checking account that provides a free cash advance of up to $250, which is considered part of their Core membership. Non-traditional employees who cannot make it until their next paycheck may find MoneyLion especially useful because they do not ask to see your employment history to get your cash advance. Instead, all you have to do is meet the following requirements:

- Have a checking account that is at least two months old.

- Show regular income deposits into your account.

- Have a consistently positive balance.

At this point you are probably wondering what MoneyLion costs, and we are happy to report there is no subscription fee for MoneyLion Core. Some apps like MoneyLion do offer higher tier subscriptions, such as the Plus subscription that is $19.99 per month, but this is not required to receive a cash advance.

What are the Pros and Cons of Using MoneyLion?

The pros of using MoneyLion are:

- There is no monthly fee or interest rate.

- Fast delivery of your cash advance with a MoneyLion account.

- They have credit-builder loans available.

- There is no transaction limit per day.

- Five-day due date grace period on your cash advance.

The cons of using MoneyLion are:

- Instant funding costs extra.

- Some features require their premium membership.

- You must have a MoneyLion checking account.

- You must have funds direct deposited to your account.

What is Instacash by MoneyLion?

Instacash is a short-term cash float from MoneyLion. This allows you to get up to $250 that could help cover an unexpected expense before payday. Other money borrowing apps like MoneyLion offer this service as well, and there is no interest on the amount floated to you. There are also no monthly fees, although you can pay a small fee to have your money deposited faster.

What Are Some of the Best Cash Advance Apps Like MoneyLion?

As mentioned above, a cash advance app allows you to get funds from your next direct deposit ahead of time. There are many out there today, so it can be hard to figure out which is the best cash advance app for you. Below we break down some of the most popular cash advance apps like MoneyLion, their features, and whether they have any additional costs.

1. Albert

To simply refer to an app like Albert as a cash advance app is a disservice to everything this app can do. While Albert does offer a cash advance of up to $250, the intention behind Albert’s creation was for it to be more of a financial advisor. Not only has the company recently added online banking to Albert’s functions, the app offers investing and personal finance advice. It also allows users to build an investment portfolio in which they can choose their own stocks or let Albert do it for them. If you are looking for a cash advance app like MoneyLion that offers additional features, Albert has you back.

2. Cleo

Cleo’s AI has an interesting persona attached to it, making it feel more like you’re conversing with a friend and less like you’re conversing with a bot. With an app like Cleo, if you are a first-time borrower, this app will lend you up to $100 with no credit checks, late fees, or interest charges. The disadvantage is that if you want to accept cash advances, you must be a member of its premium plan, which costs $5.99 per month. That’s when an option like MoneyLion might still make the most sense for you.

3. Brigit

Similar to the MoneyLion app, Brigit also will not check your credit, and does not have any late fees or interest fees. You can get up to $250 quickly with their free basic plan that also provides financial monitoring and spending insights. Their Pro Plan costs $9.99 per month but gives you everything in the basic plan, plus instant deposits, flexible repayments, identity theft protection, and credit building.

4. Dave

When looking at apps like MoneyLion, not many others stand out as being as hugely popular as Dave, which is a cash advance app with over 10 million users. This app allows you to get paid up to two days early while building your credit history. You can also get up to $500 in interest free cash advances with no fees or credit checking. To use Dave, there is a $1 per month membership fee that comes with some benefits including budgeting, balance monitoring, and setting financial goals.

5. Earnin

With Earnin, you can get an advance of up to $100 per day or $500 per pay period. They do not check your credit score or have fees. There is no membership requirement either, but Earnin does check on your spending. They monitor your bank activity with something called Balance Shield, so that you do not need to worry about unexpected overdrafts. They also offer financial and savings tools.

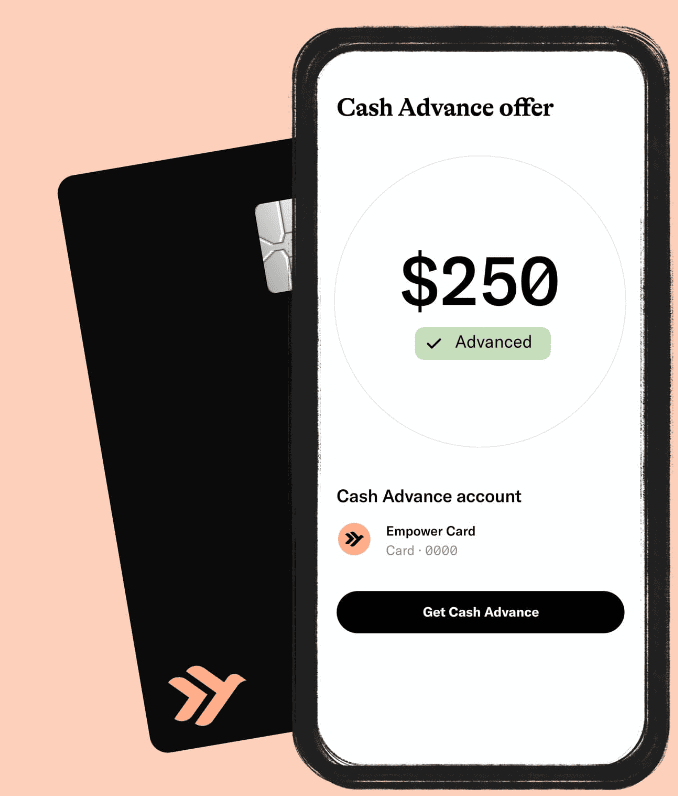

6. Empower Cash Advance

Empower will give you a cash advance of up to $250 without checking your credit. However, this app does charge $8 per month in membership fees. If you stick with your existing bank rather than opening a spending account with Empower, you are charged $3 per deposit. If you sign up for their spending account, the debit card that comes with it does have some pretty cool cash back rewards.

7. Klover

Unlike MoneyLion, Klover gives you points in return for completing activities like repaying each advance you take out on time or watching videos or ads. These points help users boost their advance amounts, which go up to $100. There is also a Klover+ membership for $2.49 per month that gives you credit monitoring and financial advising.

8. FloatMe

FloatMe does not do a lot of things, but the things that it does do, it does well. If you pay the $1.99 per month fee, you can get “floats”, which are cash advances of up to $50. They do not check your credit, and monitor your bank accounts while giving insights into your spending and savings habits.

What is the Difference Between an Online Cash Advance App and an Online Banking App?

If you are not super familiar with either type of app similar to MoneyLion, it can be easy to mix them up since they offer many of the same services. Many cash advance apps offer banking services or balance monitoring, and online banking apps usually have some form of cash advance or early paycheck access. The choice between the two types of apps is honestly up to you and what suits your needs. Below is some more info on two of the most popular online banking apps, Chime and Varo.

Chime

Chime offers a spending account with a debit card, along with access to a myriad of credit building tools. They also have a program called “SpotMe”, which is a line of credit that covers purchases which would otherwise trigger an overdraft. Users must qualify for SpotMe by having a direct deposit of at least $200 put into their account by an employer, payroll provider, gig economy payer, or government benefits payer. The SpotMe amount starts at $40 and gradually builds to $200 with a good repayment history.

Varo

Varo is similar to Chime, and currently has no fees. The app offers both checking and savings accounts, and there is no minimum balance required to get started. Varo offers “Varo Advance”, which allows users to advance up to $100 of their next direct deposit, with advances under $50 being free. Advances over $50 are charged a small fee depending on the amount, and repayments are flexible.

How Quickly Will I Get My Cash Advance With an App Like MoneyLion?

Typically a cash advance takes two to three business days to clear. A lot of cash advance apps can speed up this process for you if you are willing to pay an additional fee.

Why Are Loan Apps Like MoneyLion Better Than Payday Loans?

Payday loans are predatory and designed to trap you in a debt cycle. This debt cycle is almost impossible to escape once you are in it, because payday lenders charge ridiculously high interest rates for a short term loan that you must pay back with your next paycheck. This results in many payday loan borrowers rolling over their loans or requesting payday loan extended payment plans.

MoneyLion and other loan apps like Possible Finance and more are designed to help you build up your financial stability. You cannot borrow more than you can reasonably afford to pay back. And most of them offer extra services that will allow you to grow in the long term, so that eventually you will not need the app at all.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!