Saving money can be challenging for anyone. It can feel like bills and expenses add up so quickly and before you know it, your money is gone. When something unexpected happens, it can be earth shattering to try and come up with the money when you don’t have savings and you’re living paycheck-to-paycheck. And it’s becoming a bigger and bigger problem.

Table of contents

Let’s look at some statistics:

- Towards the end of 2019, a group was asked if they expected to live paycheck-to-paycheck in 2020. 56.4% said they did.

- 37% didn’t expect to pay into their retirement in 2020.

- 56.4% of Americans don’t have money left over at the end of the month

- 42% says it’s at least somewhat difficult to cover their monthly expenses

- 28% would define themselves as just getting by

- 23% aren’t sure they could come up with $1,000 in an emergency

- 22% believe that they will never have the things they want in life because of their financial situation

- Almost ¼ of Americans have absolutely no savings

These numbers are staggering. What’s worse, they are pre-pandemic. Since March of last year, we have all been reeling with shut downs, job loss, and economic upheaval. Many businesses have closed, people have been laid off or furloughed, and parents were forced to quit their jobs to stay home with kids who couldn’t go to school. Even more people have had to rely on their savings account to get by than before and that means many are completely drained. With around 78% of Americans living paycheck-to-paycheck before the pandemic, it’s left many destitute and trying to pick up the pieces.

This shows us why saving is so important. We can’t know what will happen in the future, but we can have a plan for the eventuality that something will always be around the corner. You can break the cycle of living paycheck-to-paycheck by following some simple savings techniques.

How To Save Money And Stop Living Paycheck To Paycheck

As bleak as the last year has been, the future’s still bright. A recent Gallup poll found that 69% of Americans surveyed say they anticipate their financial situation to improve in the next year and 50% said they are better off financially than they were a year ago. Although it’s not clear what is the difference a year can make, one thing is for sure: learning to save will always improve your financial situation and you will not regret it. Here are 5 key things to start doing today to build your savings and develop a habit of saving.

1. Make A Monthly Budget & Track Your Spending

Your first step in the effort to save more is to create a monthly budget and to track your spending. Do you know what you spent last month? It turns out that 65% of Americans don’t. How can you start saving with any real purpose if you don’t have a complete picture of your financial situation, both your income and your expenses? And without that picture, you can’t possibly create an efficient budget.

Follow these basic steps to create your monthly budget:

- Know Your Income: Find out how much you are actually bringing in. Don’t count anything that’s deducted from your paycheck, including things like taxes, pension plan contributions, 401(k) contributions, healthcare, etc.

- Document And Track Your Spending: When doing this, make sure to differentiate between your fixed expenses and variable expenses. Your fixed expenses are those that don’t change month to month, like your mortgage or rent, car payment, or cell phone bill. Variable expenses, on the other hand, are very dependent on your spending habits. Things like your groceries and food, shopping, even your electricity bill, can vary from month to month.

- Focus On Your Saving: The biggest thing is to create a habit and put at least a little away each month. Experts recommend that you save at least 10% of each paycheck. To make it easier, set up an automatic transfer for each payday.

- Analyze Your Spending Habits: To really know what your spending habits are like, you should perform an audit of your expenses. For two to three months, write down every single transaction you make, both cash and card transactions. After the period of months, look through your expenses. Add them up and you might be surprised where your money is going.

- Set Financial Goals: To really make progress, you have to have goals. It’s good to set a few short-term goals and a few long-term goals. Your short-term goals would be things like paying off a credit card or saving enough to cover one month of expenses. Long-term financial goals would include things further down the road, like paying off a mortgage or buying a house.

- Choose An Easy Budgeting Tool: The best way to stick to your budget is to have the right tools. Choosing an easy budgeting tool is crucial. Luckily, there are many apps and free spreadsheets available online. We will discuss these more below.

As you follow this method for creating a simple budget, you’ll find you gain valuable insight into your financial health, your habits, and what drives you. It’s the first step to maintaining strong finances and pulling yourself out of the paycheck-to-paycheck rut.

One of the important things mentioned in the steps for creating a budget were the options for apps and spreadsheets. Before continuing, we will look further into those.

Budgeting Apps

There are hundreds of budgeting apps out there like Stash app (Stash review), from apps for banking to apps that will actually handle the saving for you. Do your research before choosing the app that works best for you. Consider what your purpose is getting the app. That will determine which one you should choose. For example, if you are looking for an easy general budgeting app to help you keep track of your budget on-the-go, you likely wouldn’t want to download Digit, who’s focus is automatically rounding up each transaction and sending that amount to a savings account. However, if you want to take the guesswork out of savings, Digit would be a great solution, more so than your bank’s mobile app.

Spreadsheets

An option that’s still popular with many people is a simple budget spreadsheet. Thanks to the internet, you have a variety of options. Here are some of the most popular ones:

- Vertex42 Spreadsheets: Vertex42 offers monthly and yearly household and personal finance budget spreadsheets. They have a variety of options, from Christmas gift budgets to business budgets and even a Money Manager Spreadsheet meant for kids.

- It’s Your Money Budget Spreadsheets: The free It’s Your Money Budget Spreadsheets include a Cash Flow Budget Spreadsheet, inspired by the budgeting methods of Dave Ramsey, and a Box Budget Spreadsheet, which breaks down each month into four weeks so you can easily visualize your expenses, savings, and income.

- PearBudget Free Budget Spreadsheet: For a comprehensive household monthly finance spreadsheet, the PearBudget Free Budget Spreadsheet is a great option. With the analysis tab you can analyze expenses by different categories and show the difference between the actual spending versus the budgeted spending, including unexpected expenses.

- Google Sheets: By far one of the most simple ways to create a budget spreadsheet, Google Sheets has several budgeting templates. The monthly budget template gives you a simple spreadsheet that’s great for uncomplicated financial budgets. The yearly budget gives a more detailed yearly and monthly budget that also lets you project your income and savings.

- Tiller Money: Although not a spreadsheet template, Tiller Money is an excellent choice because it offers spreadsheet integration with your bank account. There are many options so you can create and customize a report exactly how you’d like it.

- Microsoft Office Templates: Similar to Google Sheets, the Microsoft Office templates are easy to use, widely available, and free. There is also a large variety of spreadsheets, including one for household expenses, one for holiday shopping, and another for college budgeting.

Budgeting Tips

There are a couple of last pieces of advice that can help ease your budgeting process:

- Keep your goals in mind. Whatever goal you have, that should drive you and inspire you to budget and save more. When you start to accumulate a significant amount of money in your savings account, you might be tempted to spend it. By keeping reminders of your goals around you – like post it notes, pictures, and benchmarks – you’ll be more likely to stay strong and hold out for your goal.

- Budget for potential problems. What the COVID-19 pandemic has taught us is that you can’t predict what will happen in the future. All you can do is plan to be as prepared as you can be. To give yourself security, you should budget for potential problems and the unforeseeable.

2. Identify Ways To Save More Money

With your budget in mind, you can now focus on creating a reserve stash of cash that you can fall back on if you need to. It all starts with finding hidden ways to save money.

Negotiate Bills

Start by trying to negotiate down your monthly bills. While you may not be able to do much about having certain bills, you could be paying less. For example, refinancing is a great way to reduce your car payment or mortgage. You may even have the chance to take advantage of lower interest rates, too. The same can be said for your student loan payments.

For other bills, you simply need to take the time to shop around. When your car insurance or renters insurance policy comes due to be renewed, invest the time in looking around for other options. You stand to save hundreds of dollars a year. For car insurance, try Gabi, a website that can find you a less expensive option. Another example would be your cell phone payment. By switching carriers, you can save big money. A new option that’s gaining popularity is Twigby, a discount carrier that could get you out from under the big guys.

Be Smart With Unexpected Money

Whether you find a quarter in your pocket or someone gives you money for your birthday, be smart about the money you come into unexpectedly. In fact, you should get in the habit of emptying your pockets or purse at the end of every day and setting aside all the coins and extra cash that you find. Then, quickly take that set aside currency to your bank and deposit it directly into savings. Then you won’t be tempted to spend it. You can also try the $5 trick where you save every single $5 bill you come across.

Say you’ve been working hard and are rewarded with a raise. Instead of expanding your lifestyle to once again fall in the paycheck-to-paycheck cycle, you should instead continue to cut back and put that extra income directly in savings each paycheck. It’s an easy way to boost the amount you’re saving without having to cut back too much. Speaking of savings, you should make sure your savings account or emergency fund is separated from your checking account, preferably in a way that makes it harder to access.

Be Smart About Shopping

We all have to go shopping every now and then, whether for groceries or for other things we need. But there are ways to be smart about it that you may not have thought of. For example, experts advise that you go shopping on Wednesdays whenever possible. Statistically, that’s when most grocery stores launch their new sales. You can also use coupons and coupon apps to save on each transaction, compounding the amount you save.

Before you go grocery shopping, plan out your meals for the week and put together a list. It’s so easy to simply browse the aisles and pick out whatever sounds good. But that method doesn’t guarantee you’ll have the right foods to make meals and you could end up eating out as if you didn’t go grocery shopping, meaning you’re spending double. While you’re grocery shopping, try to buy generic. Often there isn’t a notable difference between the name brand and the generic brand, so you’ll end up paying more just for packaging.

When it comes to impulse shopping, a quick way to curb that habit is to restrict your online shopping. Our lives are so easy that with the click of a button, you could have that new vase that caught your eye or a brand new pair of shoes. If you don’t need these things, then you’ve just wasted money and fallen back into habits that have locked you into the paycheck-to-paycheck cycle. If you do have to buy something other than groceries and home essentials, ask when it will go on sale.

Be sure to cancel all unnecessary subscriptions. These are easy to forget about and can cost you hundreds of dollars a year in services and products that you haven’t used. Review your streaming services, too. It’s likely that you only use one or two, but might have several.

Be Thrifty

Making an effort to save more and get yourself out of the paycheck-to-paycheck rut has a way of making a person creative, especially when it comes to money saving tactics. A basic habit to get into is reusing things. That sandwich bag you threw some carrots in? You could just wash that out and reuse it. That old butter container? You can put leftovers in it! Along those lines, you can try making DIY gifts instead of shopping for something. It will be more personal and you’ll save money.

An often overlooked place to shop is the thrift store, but if you need new clothes or furniture, it’s a great option. Often you can find things that are new with tags or nearly new and in great condition. And you’ll end up spending far less than you would in a store. Speaking of thrifting, try selling some of your own stuff that you aren’t using anymore. If it doesn’t improve your life, bring you joy, or get used, why not sell it to someone who could actually make use of it? It’ll be a little extra income and it’ll make you feel lighter.

You can also try bartering services. If you know how to do something or have special skills, you could trade those for something you need. For example, if you know how to groom dogs and you need a haircut, consider finding a hairstylist with a dog who you could do a trade with. It’ll save you both money without sacrificing the things you need.

Change Your Habits

All of us have a few spending habits we could do without. By changing some of your habits, you can easily save money. One example is ordering smaller meals or portions at restaurants. You’ll avoid overeating and save a few bucks. You should also get in the habit of monitoring your electric bill and your electricity usage. In some places you can even have the electricity company come out and identify which appliances are using the most electricity. Then, get in the habit of unplugging those when they aren’t in use.

One habit that will have tons of benefits is unsubscribing from those emails that are cluttering up your inbox. Why put in the effort instead of just deleting them as they come in? Because they are written by marketers who are good at what they do, meaning they are banking on you seeing the email and making an impulse purchase. Avoid the whole thing by simply hitting unsubscribe. If all else fails, you can try a spending freeze where you don’t buy anything non-essential for a week (or even a month). Also known as a contentment challenge, this has the added benefit of teaching you how to be content with what you already have.

Above all else, be patient with yourself. That’s a habit almost everyone could stand to adopt. There will be times you slip and indulge a little. That doesn’t mean your financial journey is over. It’s just a speed bump! Get back on track and keep going. If you need to, get a friend or family member to act as your accountability buddy, someone who can help you stay accountable because you report your spending to them. With a little extra help, you might just make it over the first hurdle of changing your habits.

3. Reduce Credit Card Debt & Find Debt Relief

Today, most people have at least one credit card. And why not? They are so easy to use! No carrying the right amount of cash and you can just pay it back later, right? The truth is credit cards keep you in the paycheck-to-paycheck cycle. You rack up a huge balance and then your interest is so high that you barely make a dent in the debt, so you’re essentially just signing up to pay for the interest. This debt robs you of your money. If you have credit card debt, you don’t need to panic. There are ways to get out of it. Let’s take a look at two of the most popular credit card debt-relief methods:

Snowball Method

Imagine you make a snowball and roll it down a snow-covered hill. It will start to pick up more snow, growing and growing as it rolls. It’s this concept that the Snowball Method is built on. It’s all about momentum! And it’s all done in three easy steps:

- Look through your debts and figure out which account is the one you owe the least on.

- Increase your payments as much as you can on that account while still making the minimum payment on your other accounts.

- Once that small account is paid off, roll the payment you were making into the next highest account. So, you will end up paying the minimum on the next account plus whatever you were paying to the first account.

Using this method, you can start paying off accounts quickly without missing money – it’s just the same amount you were paying before, just to fewer accounts. While you might pay more in interest in the long-term, this method has the benefit of the gratification of quickly paying off small accounts. This can be a great motivator to keep working on your debt relief.

Avalanche Method

While the Snowball Method starts small, the Avalanche Method works much like an avalanche, by going big. For this method, follow these steps:

- Look through your accounts and find the one you owe with the highest interest.

- Keep making minimum payments to your other accounts, but pay extra towards this account.

- Once that account is paid off, roll the money you were putting towards it in the next highest interest rate account.

There’s a huge benefit to choosing this method: in the long-run, you won’t pay as much. This happens because you’re tackling debts based on their interest. That means you will pay off your high-interest accounts first, leading to you paying less interest over time and ultimately less as a total. The downside is that accounts may not close as quickly which won’t incentivize you like the Snowball method does.

Tips For Credit Card Debt

It’s so hard to not abuse credit cards, especially in today’s world where cards are so readily accepted. Here are a couple final tips to help you with credit card debt:

- Leave your cards at home. If you don’t have them with you, you won’t be able to use them. Doing this is a good first step for many people to get them back in the habit of using real money instead of credit to pay for things.

- Consolidate your credit card debt. You can do this with a loan from your bank or check out AmOne, which matches you with a low-interest loan to use to pay off every single one of your credit cards. This can reduce your overall monthly payment and lead to you paying less in interest over time.

- Cut up your cards. Once you have one paid off, if the interest rate is high or you want to stop abusing your credit cards, take a pair of scissors and cut your card up. That eliminates your option of using in one go.

4. Make A Monthly Savings Plan & Stick to It

Making a monthly savings plan is something many people forget about. We often talk about budgeting and part of that should be your savings plan. It’s just as important as staying within your budget to get out of the paycheck-to-paycheck cycle.

To start creating your savings plan, try these tips.

Start Where You Are

No matter where you are in your savings journey, you can start to become a saver and learn how to stop living paycheck-to-paycheck. Begin by taking a fine-toothed comb to your finances. You need to really know how much money you have coming in, what money is going out and where, and what are your needs versus your wants. The essentials would be those things you absolutely need, like your rent, mortgage, medication, electricity, phone, etc. The wants are the extras you buy, like going to a restaurant, paying for entertainment, new clothes (unless you really needed them).

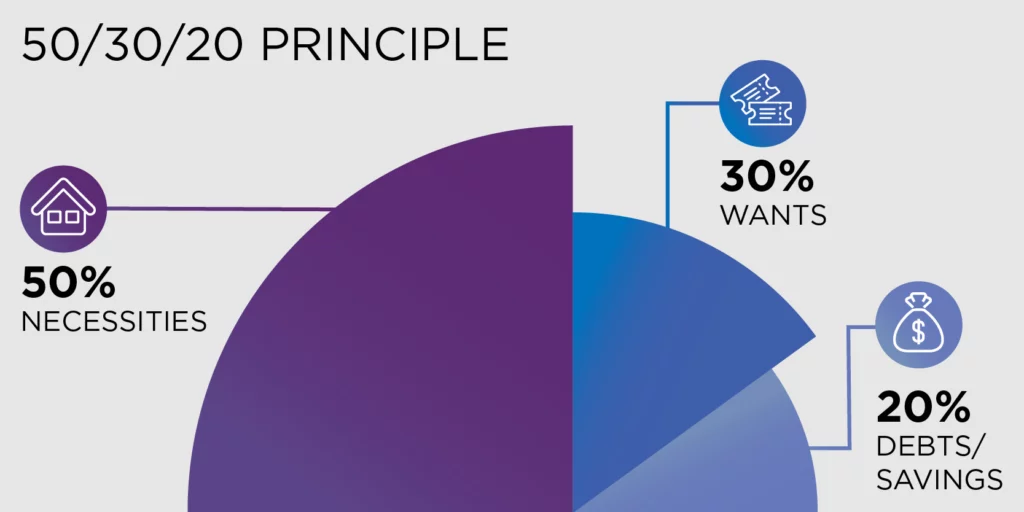

When you start creating your budget with a savings plan included, consider using the 50/30/20 rule. It breaks down like this:

- Essentials = 50% of your income

- Wants = 30% of your income

- Savings = 20% of your income

By prioritizing your essentials and factoring in your savings, you’ll not only be able to budget more easily, but you will secure a portion of your income for savings every paycheck. Look for ways to cut back on your spending where you can if you have trouble meeting your 50/30/20 goal and you’ll quickly find those things you don’t actually need and can do without.

Get A High-Yield Savings Account

Do you have a savings account? It turns out, according to a Mintel survey, that about 73% of consumers have a savings account, but the average savings account only has a 0.05% Annual Percentage Yield (APY). The APY is the interest you gain on your saved money. The smaller the APY, the less return on your investment into your savings account. Instead, you should be using a high-yield savings account.

The difference between a high-yield savings account and the typical one is that you’ll get more of a return because the APY is higher. Often you’ll find these with online banks because they pass on the savings of not having brick-and-mortar locations to the consumer in the form of higher APYs. With this compounding APY at a higher percentage, you’ll gain more over the long-term and you’ll start to see your balance grow. Do your research into the top online banks with high-yield interest.

Create A Savings Goal

You can’t get anywhere without a goal and saving money is no exception. Without a goal in mind, you may quickly lose your motivation to save money and you’ll fall right back into the paycheck-to-paycheck routine. A good place to start is setting a goal of how much you want to save each paycheck. If you plan on using the 50/30/20 breakdown for your budget, you may want to make your first savings goal increasing your savings until you reach that 20%. Another option would be setting a length of time – like one year – of saving a certain percentage. Whatever your goal is, set a short-term goal that plays into your long-term goals.

Automate Savings

Arguably the easiest way to start saving is to automate it. That takes the guesswork out of it completely. And today it’s easier than ever! A report by Mintel found that 54% of banking customers whose bank is online find that mobile apps make it easier to deal with banks. Thanks to the development of banking apps and the increasing movement online, you can easily handle banking transactions from the touch of your phone.

There are plenty of ways to use apps to help you save money and learn how to stop living paycheck-to-paycheck. First, set up an automatic transfer for every paycheck. You can manage this on your bank’s mobile app. Another option is to use apps like Digit that automatically round your transactions up to the dollar and save the rounded amount in a separate account for you. Then you would simply transfer that separate amount directly to your savings account every month and watch your savings grow. However you do it, take advantage of online money management as much as possible.

Level Up

You’ve been saving like crazy and you reach your first short-term goal. What then? Now it’s time to level up your saving. Start to look for more ways to save. Are there bills you can negotiate? Roll the savings into your actual savings account. Can you negotiate a raise? Put that extra money into your savings account. Even finding little ways to save money, like cutting back on your favorite daily soda or starting a small side hustle, can make a big difference.

You should also use this opportunity to reassess your savings goal and possibly set a new one. If you’ve reached your original short-term goal, look to level up your goal and start trying to save for three to six months’ worth of expenses. Or try to save a certain dollar amount. Whatever your next short-term goal is, keep it in mind and have reminders around like you did your other goal.

Another option is to start looking into investments. The idea of starting your investment portfolio might be a little intimidating but it can be very lucrative if done correctly. Before you start investing, do your research and make sure to keep in mind that investing in things like stocks is always a gamble, so don’t invest more than you’re willing to lose. Any of these ideas can have your savings account soaring if you are willing to commit to them

5. Reassess Your Budget At A Consistent Frequency

With your budget in place, a strong savings plan, and new money habits, you’re well on your way to pull yourself out of the paycheck-to-paycheck cycle. However, the work doesn’t end. You should regularly reassess your budget. Consistently look through your budget and assess how you are doing sticking to it, how it’s working for you, and adjust it accordingly. Are you still sticking to the 50/30/20 plan? Where are you in respect to your savings goals? Can you do more to be paying down your debt? As you reassess, you might find that there are things you could be doing better and you’ll love to see how far you’ve come. Getting into this habit can also keep you from falling into bad habits again or giving up on your ultimate goal of breaking the paycheck-to-paycheck cycle.

Stop Living Paycheck To Paycheck Today

The coronavirus has hit all of us and if you’re one of the millions of Americans who was laid off, furloughed, or lost income, you are likely reassessing your finances and especially your saving and spending habits. Loss of money has been a part of the pandemic for so many of us and you are not alone. Now as we move through 2021 it’s time to make your plans for how you can avoid living paycheck-to-paycheck and have a reserve of money that you can fall back on.

The good news is that there are ways to get out of the cycle and to find security again. Start by making a monthly budget. Start by really knowing how much you have coming in. Comb through your spending habits and see where you can cut back. Focus on your savings and set your financial goals, both short-term and long-term. And be sure to rely on any one of the free and easy-to-use budgeting apps out there or one of the budgeting spreadsheets available. These can help you stay on track with your budget and your savings.

Next, make sure you know all the ways you can save money. Start by negotiating your monthly bills. You may be able to pay less than you are. Be smart when you have an unexpected windfall of cash and put that towards your savings goals rather than spending it all. You should also develop good shopping habits that will help you save money and get more for what you spend. Along those lines, be sure to be as thrifty as possible. Just because something is used doesn’t mean it’s bad. Ultimately, you will find ways to save as you change your habits.

As you are revamping your finances, ask yourself where you are with your credit card debt. Are you relying on them too much? How are your interest rates? Are you getting anywhere in paying them down? Try the Snowball Method or the Avalanche Method to pay them off faster and ultimately pay less. Make a concerted effort to work those balances down so you aren’t simply paying for interest every month.

Finally, focus on your savings plan. Look at your spending in an open and honest way. Where can you cut back? From there, make sure you have savings built into your budget, like with the 50/30/20 method. Make sure you are using a high-yield savings account to get the biggest return on your investment into your savings. As you save, have your goals in mind, both short-term and long-term savings goals. These should be goals specific to savings, like paying off your credit card debt or saving three to six months’ worth of expenses.

Next, automate your savings so it happens automatically without you having to do anything. You can do this with your bank’s mobile app or with an automated savings app like Digit. Then, when you reach your first goal, level up. Take your savings to the next level by finding more ways to save and more goals to reach.

You can escape the living from paycheck-to-paycheck mindset. You are not stuck there. With these simple lifestyle changes and habits, you can start living your dreams and having the financial security you’ve always wanted.