8 Financial Goals You Should Have For 2023

Posted on February 1, 2021 in Money

The COVID 19 pandemic has caused ripple effects that will be felt for decades in just about every single aspect of day-to-day life. The economy and financial world were not spared and in some ways were affected even harder. As life returns to a new normal, we can start to look toward a potentially brighter future. The world is becoming more stable, and the time to start rebuilding is here. It’s time to start setting some financial goals for 2023.

Table of contents

1. Create A Budget

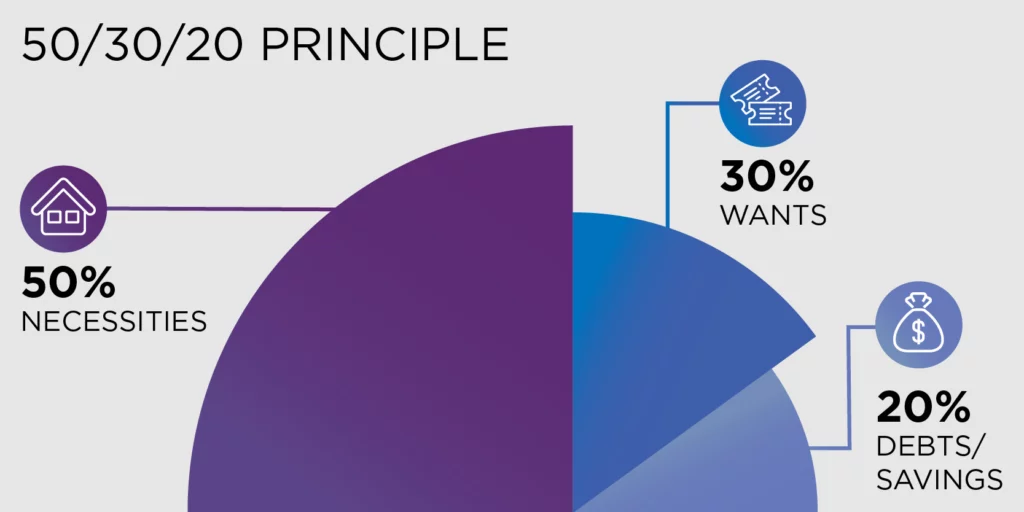

The first step in the process of achieving and maintaining financial stability is to create a budget. Every cent coming in and leaving your possession needs to be accounted for and documented. One of the more popular methods is the 50/30/20 principle, where the goal is to have 50% of your income budget for necessities (such as housing, utilities, and transportation), with 30% budgeted for wants (eating out, entertainment and clothing) and 20% budgeted for repaying debts and savings. This method may not work best for everyone depending on income, rent, and other details, but it can give you a rough idea of what your finances should look like when making your budget.

2. Trim Expenses

Now that your funds are accounted for, it’s time to trim some of the fat. The more unnecessary and wasteful spending you eliminate, the more money you will have to accomplish other goals. A common method is to itemize recurring payments and create a list ranking them in order of importance. Necessities like food and shelter would naturally be at the top, while luxuries like a cable bill or gym membership should fall much lower on the list. The question to keep in mind is, “Do I need this, or do I just want this?” Refer to the 50/30/20 method mentioned above: If you are spending 30% of your monthly income on wants, then you will have plenty of opportunities to save more money.

Some common examples of trimming daily and monthly expenses would be:

- Cooking at home instead of dining out

- Buying clothes at a thrift store instead of buying new

- Doing your own haircut at home

- Canceling unnecessary subscriptions and memberships

3. Explore New Streams Of Income

You should always be looking for ways to increase your income. Some people work two or more traditional jobs, but that doesn’t necessarily have to be the only option. With the creation of the internet, there has never been an easier time to create new streams of income. For example, take people who stream video games: They make thousands of dollars filming themselves playing video games live for an online audience. This is just one example; there are countless ways to make money thanks to new online avenues of generating revenue. The idea is to utilize your time and make as much money as you can to help ease your monthly budget.

4. Pay Off Debt

Once you’ve created your budget and saved up some income, you will have freed up more funds to allocate toward your goals while paying off debt. Paying off debt can go a long way towards making your life less stressful and will save you money in the long term and boost your credit score. There are two types of methods for paying off debt. They are:

- Debt Avalanche

This method focuses on the interest rate above the total balance. Make a list of all debts in descending order from the greatest amount to the smallest amount. Ensure that the monthly minimum due is being paid for each item. Then, focus your remaining funds on the debt with the highest interest rate attached and continue to pay that off until the balance is zero. Continue this method for the next highest interest rate, and so on.

- Debt Snowball

This method focuses on the total amount due instead of the interest rate. For this method, make a list of all debts in ascending order from the smallest amount to the greatest amount. Budget every debt to allow for minimum monthly payments, and use all remaining funds to pay off the lowest balance until it is closed. Then the lowest will be the primary focus and so on until all balances are zero.

5. Start Saving More

If COVID has taught us anything, it’s that life is uncertain. That’s why beginning to save money is so important. A robust savings account can be a life-saver in uncertain times. When determining how frequently and how much to deposit into your savings, try to save at least three to six times your monthly expenses. If you suddenly find yourself without a stable monthly income, your savings will help you survive for at least a few months until you get back on your feet. It’s even better if you can save more than three to six times your monthly expenses.

6. Think About Retirement

Most employers offer up a matching program with their employees’ 401(k) retirement plans. Sometimes we stay stuck in the present and do not plan accordingly. Retirement is a long way away, but why not start saving up for it now? Yes, the more money you put into your 401(k), the less take-home pay. But if your employer is matching that money, then you would be turning down free money for a few more dollars per check.

7. Look Into Investing

Investing is a long term opportunity to make your money work for you. The real estate and stock markets can be turbulent, but you can come across opportunities to enter the stock market at lower share prices. There are also crowdfunded options to consider investing in such as DiversyFund vs Fundrise real estate platforms. The ultimate goal is to buy something for less money than what you will sell it for. Once your present finances are stabilized, debt is paid off, savings are growing, and you’re adequately preparing for retirement, then it could be an excellent time to start investing.

Investing should be a lower priority on your list because gains in the stock market and other investment avenues are not guaranteed, and you could end up losing money. Investing comes with risks. However, it should be noted that any money you invest should not be a fund you depend on in difficult times or to pay for a personal expense.

8. Treat Yourself

While this item may seem counterintuitive to the rest of the list, it still deserves its place on your financial goals for 2023. This past year has been mentally and emotionally exhausting, and many of us are feeling the effects. Life does not always have to be about money. When the time is right, consider taking the vacation you’ve been putting off or making that purchase you’ve wanted but couldn’t afford. As long as you spend responsibly and can effectively budget your expenses, then treating yourself to something personal should be on your list as well.

The Takeaway: Set these financial goals for 2023 and you can begin repairing any financial setbacks caused by COVID-19. You may even improve on your pre-COVID-19 finances.

The last few years have caused a lot of people to understandably stop looking toward their economic futures and focus on their present situation. However, now is the time to start looking forward and not just getting back to normal but improving and creating a better future financially. Accomplishing any of these goals will go a long way toward helping you achieve long term financial stability.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!