What Happens If I Only Pay the Minimum on My Credit Card?

Posted on July 8, 2021 in Credit Cards

Offering only the minimum payment keeps you in debt for a longer period of time and increases your interest charges. It may also jeopardize your credit score.

Table of contents

- When You’re Only Making a Credit Card Minimum Payment, Paying Down Your Debt Will Take Longer

- Making Only Minimum Payments on a Credit Card Will Cause Interest Rates to Climb Higher

- Minimum Credit Card Payments Can Affect Your Credit Score

- Facts About Only Paying the Minimum Payment on a Credit Card

- FAQ’s About Only Paying the Minimum on Your Credit Card

Only making a credit card minimum payment seems like a smart bet at first glance. You don’t get any late fees and your credit card stays in good standing. The more you look at it, though, it’s not such a good deal, and turns out to be a really bad idea. You’re doing almost nothing to cut down on your original debt. The principal balance barely gets touched, and your credit card repayment time goes through the roof. Lets look at some of the particulars when it comes to paying the minimum payment on a credit card, and what strategies make the most sense. A few calculations will show that sticking with making minimum payments on a credit card is probably something you don’t want to do.

When You’re Only Making a Credit Card Minimum Payment, Paying Down Your Debt Will Take Longer

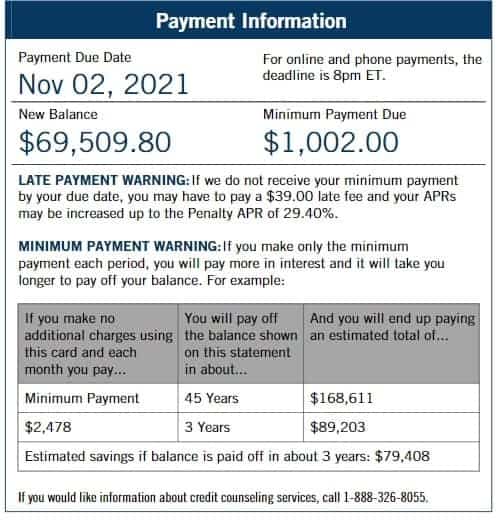

Let’s deal with the first real problem. Minimum payments may keep your card in good standing and keep you from late fees, but that’s about all they do. A minimum payment is the smallest amount a credit card company will let you pay to keep your card active and not be late. Most credit card companies calculate the amount carefully to benefit them, of course. It usually comes out to somewhere around 1% to 3% of the total debt. As of the beginning of 2021, Bank of America and Chase had a minimum payment of thirty-five dollars ($35), while Wells Fargo and City had a minimum payment of twenty-five ($25). Every time you make a minimum payment, the card company is required to give you a little warning. Most people ignore that small print, but let’s look at it closely.

Let’s Take A Look – It usually says something like, “Minimum Payment Warning”. They show you a table that lets you know how long it take to pay off the full debt if you keep paying the amount you just paid. You generally find that the amount of time it’s not going to take to pay everything off has jumped by a number of years! Because you made such a little payment, and are accruing interest all this time, the debt is actually growing. Even though you’re avoiding late fees, you’re doing almost nothing to pay down the original debt.

It might surprise you to know that if you just doubled the payment, you’d cut the repayment period in half. That’s according to Ed Mierzwinski, former director of the non-profit group U.S. Public Interest Research Group.

Making Only Minimum Payments on a Credit Card Will Cause Interest Rates to Climb Higher

This is the next big drawback to making minimum payments only. You feel like you’ve got more money because you’re paying less a month and keep more in your pocket, right? What they don’t tell you is that only works if you have a zero annual percentage rate agreement (0% APR). Even if you got a zero percent deal when you started your card that probably only applied to certain purchase and probably lasted for a brief time. If you do have such a deal, stop making minimum payments immediately if you can. Pay off that debt entirely and you will pay no interest on it. You’ll be glad you took care of it early and saved yourself so much money.

If your zero percent deal has expired, or if you never had one to begin with, let’s look at how the interest rates climb when you make only minimum payment per month.

Let’s Take A Look – The terms and conditions of credit card issuers are often confusing. To find out how much interest you’ll be charged you first have to divide the annual percentage rate of your card’s by 12, then multiply that number by your average balance. As an example, if you had a card with a twenty-five percent annual percentage rate (25% APR), then your monthly interest rate would come to 2.08%. Go ahead and multiply that number by the amount of your balance. If you’re carrying six thousand dollars ($6,000) a month in debt you end up owing one hundred sixty eight dollars ($168) in interest next month as a result of making only minimum payments. As you can see that number would be less if your monthly balance were lower.

Interests charges add to your total debt amount. That means next month when the same minimum payment calculation is done, the one hundred sixty-eight dollars will make the next interest cost even higher. It doesn’t take a math genius to see how this quickly gets higher and higher, and worse and worse. What looks like it’s saving you money each month is actually putting you further into debt, and you may end up needing to consider if something like debt settlement might be worth it for you eventually.

Minimum Credit Card Payments Can Affect Your Credit Score

Every credit score is affected by what’s called the credit utilization ratio. Lenders use this piece of your credit report to decide if you’re a good risk for a loan. It is affected by the amount of debt you owe, so the extra interest brought on by making minimum credit card payments definitely has a bad affect on the credit utilization ratio’s bottom line. You calculate your ratio by taking how much you currently owe divided by your credit limit. When your credit card balance goes up, your ratio goes up. As we said, that makes it harder to qualify for loans, not to mention housing rentals, car rentals and new credit application qualifications.

Let’s Take A Look – Let’s say you have a total credit limit of eight thousand dollars ($8,000). Let’s also say that out of that limit, what you owe right now totals to six thousand dollars ($6000). If we divide the second number by the first number we 0.75, or seventy-five percent (75%).

That’s an extremely high credit utilization score. Banks want it no more than forty-three percent (43%) before they even consider a loan. Personal finance planners suggest that you keep it no higher than thirty percent (30%) if you want to be considered really credit worthy.

Facts About Only Paying the Minimum Payment on a Credit Card

- Did you know that less than 20% of a typical minimum payment goes to principal? That’s right. You’re making almost no dent in the principle with a minimum payment. That’s why the repayment time is suddenly so long and only gets worse.

- Did you know that your minimum payments set you up to be in debt for over 10 years? Not only are we talking about a full decade to repay what probably is only a few thousand dollars, if you don’t get control of the interest that can be additional years or even another full decade.

- Are you surprised at how little the balances have gone down? They can’t go down. Most of your payment is paying for interest. Since the additional interest costs only add to the balance, there’s no way you can catch up anytime soon with minimum payments.

What To Do if You Can’t Pay Off Your Balance in Full Every Month

Let’s face it; most people are making the minimum credit card payment because the amount is so high they can’t pay off the balance. If that’s your situation, what should you be doing?

If you can’t pay in full, you should at least make the minimum payment. Racking up late fees and getting bad standing with the credit card company will only dig you a deeper hole. You need to cut down those mounting interest payments, and you may even want to considering settling credit card debt vs paying in full. Here are a few steps that can help:

- Pay More Than The Minimum Amount – Increasing your monthly payment lowers you mounting interest. As we mentioned earlier, if you double the payment, you cut the repayment time all the way down to half.

- Stop Making Credit Card Purchases – Unless it’s an emergency, stop digging. The hole’s only gets bigger because you’re making it grow. Bite the bullet on whatever purchases you’re making, especially if you were spending money on non-essentials.

- Don’t Use Your Card For Daily Purchases – This is similar to the above suggestion. Even though many daily purchases, such as food and gas, are essentials, it’s a terrible habit to buy them with a credit card. Paying with debit or cash generates no interest payments. If you’re buying daily items with a credit card, you’re literally ‘living off the card’, which means you’re living well outside your means.

- Don’t Pay Medical Bills With A Credit Card – Just like the previous point, this purchase may be essential, but it’s not the kind you pay with a credit card. Medical bills often mount unexpectedly. Sometimes you can get outside help with them, but that’s complicated if you’ve tied them to credit card debt.

FAQ’s About Only Paying the Minimum on Your Credit Card

Let’s look at some frequently asked question and answers to wrap up our perspective on the hazards of making minimum payments on a credit card.

What happens if I only pay the minimum on my credit card?

- You won’t be charged late fees, and your card will stay in good standing. You will have almost no effect on your credit balance, since less than twenty percent of the very low payment actually pays down the debt, while the card still charges you high interest for carrying a balance.

Is it OK to pay the minimum payment on a credit card?

- It’s fine to make minimum, especially if you cant afford more. The longer you do so, however, the more debt you accrue and the more likely you are to make a financial mistake.

Is it better to pay off a credit card or make the minimum payment?

- It’s always better to pay off your credit card balance. In the long run you pay a lot less, sometimes as much as half of what you pay if you go the minimum card payment route for any length of time.

Does it hurt your credit score to pay only the minimum payment?

- The longer you carry any debt it hurts you. Even if your credit card bill wasn’t that much when you started making minimum payments, it would probably be more by the time you stop the practice. If you need help to pay off your credit card debt, the Bright Money app is an excellent choice.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!