Bright Money Review 2023: Everything You Need to Know

Posted on March 1, 2022 in Credit Cards

Bright is a useful app for people who are on a fixed income, living paycheck to paycheck, or struggling with credit card debt. In this comprehensive Bright money review, we’ll look at how the Bright app can help you save money, manage your debt payments, and stay on track with recurring payments.

- Bright Money Overview

- A Review of The AI Behind Bright Money

- Paying Off Credit Card Debt with Bright Money

- Increasing Credit Score with Bright Money

- Build Savings with Bright Money

- Bright Money Customer Service Review

- Bright VS Tally

- Frequently Asked Questions

Financial management app Bright is marketed as a way to help users pay their credit card debt, collect savings, and increase their credit score. Also known as Bright Money, the app uses artificial intelligence to guide users towards smarter financial decisions. Instead of focusing mainly on providing debt advice like other money management apps, Bright takes a different approach, focusing on tangibly helping with managed debt before anything else.

Here’s everything you need to know about the financial management app in our in-depth Bright Money review:

Bright Money Overview

What is Bright Money?

As a financial management app, Bright goes deeper than its average counterparts. Bright Money is a cutting-edge money management app that can assist you in paying off your credit card debt. In order to streamline the process of building financial health for its users, Bright connects with their accounts. Through this connection, it withdraws funds from the users’ bank account automatically in order to apply them towards a debt. In this seamless manner, Bright Money helps you pay off debt and build your credit with ease.

Bright Money’s overall goal is to help you pay your credit card debt. With that goal in place, when you sign up for Bright you can also use the app as a way to improve your credit score and begin to build savings.

Bright works by looking at your income and your bills in order to determine what you can afford to pay on your credit card debt. Then, instead of only paying your minimum payment at the end of the month when you’re left with little to spare, Bright pays your debt using the money that it had previously set aside. This allows you to pay more on your debt each month, as you are paying when you have money instead of when you are in lack.

The money management method that Bright uses has been proven effective time and again. It simply encourages you to pay what you owe first thing instead of waiting. By using the Bright Money app, you don’t even have to think about it. Instead, the process is set up and happens automatically, allowing you to pay off your debt while barely noticing the change to your bank balance.

Is Bright Money Safe and Legitimate?

Bright Money is a legit app designed to help you pay down debt fast, save money, and improve your credit score over time. However, in order to effectively use the app, users must be comfortable opening their bank account to it.

Not only do you need to give Bright Money access to your bank account, you also need to give the app permission to make transactions. While this has become fairly commonplace today, many people are still wary about giving this personal information and access to an AI program.

You don’t need to worry about safety and privacy when you use Bright Money. The app uses a financial services company called Plaid. This company has multiple strong security features including multi-factor authentication and end-to-end data encryption for storing and connecting banking and credit card information.

All of your money that is stored and transferred by the app is FDIC-insured, providing you with another level of security. Comped to the competition, this is important factor that distinguishes Bright Money as a legit company to turn to for help paying down debt.

A Review of The AI Behind Bright Money

Bright Money uses artificial intelligence for its recommendations, stores, and transfers. Bright’s AI is its own patented technology known as MoneyScience, which uses a complex algorithm pattern as it learns about a users’ finances and their goals. It then puts the collected data to work by moving around funds to pay debt and increase savings.

The AI process begins when you sign up for Bright. During enrollment, you will be asked to provide personal information including:

- Your name

- Your address

- Your gross annual income

- Your main financial goal.

- Your bank account information, which you will link to Bright.

Bright Money Savings

The next step in using Bright is the creation of your FDIC-insured savings account. In the app, this is known as Bright Stash and it is the place your money is stored before being dispersed.

Every two to three days, AI determines how much you can afford to have sent to your Bright Stash, and then it transfers the money for you. This is known as the Smart Pace. However, you can opt for having money transferred at a pace you are more comfortable with, such as when you are paid or every week. You can even choose to have your money transferred manually, when you’re ready.

Your money is stored in the savings account while the algorithm decides the best way to use the funds based on your goals. Once it determines your funds’ recipient, your money is sent to make a payment to that credit card (or a deposit in your personal savings account).

Paying Off Credit Card Debt with Bright Money

The main purpose of Bright Money Co is to help users pay off credit card debt. A review shows the app accomplishes this by using AI to take inventory of your accounts, including your current balance, your APR, and the required monthly minimum payment due.

By giving Bright access to your checking account, it is able to see your spending habits, as well as your monthly expenses. It considers your upcoming bills, expenses such as food and gas, and even determines a minimum balance for your checking account. With this information, the algorithm decides how much you should be paying on your debt each month and which of your credit cards should be prioritized first.

Bright utilizes the Smart Pace of transferring money every 2-3 days unless you specify otherwise. This means that any extra income will be factored in and transferred within just a few days of the deposit.

Bright Money prioritizes credit card debt using the debt avalanche. This method prioritizes the card with the highest APR and pays it off before moving onto the next. However, users have the ability to change the way that Bright Money prioritizes debt. They can choose the debt snowball method or debt avalanche, or manually pick the debt that they want paid off first.

Increasing Credit Score with Bright Money

Having multiple high credit card balances keeps your credit score on the lower end of the spectrum. Credit scores are affected by a number of factors worth reviewing. These include:

- Age of credit accounts

- Credit utilization rate

- Payment history

- Credit inquiries

- Mixture of types of credit

Bright helps with the payment history and utilization rate portion of your credit score. It ensures that all of your credit card payments are made on time and helps you consistently lower the utilization rate on each card.

For a good credit score, credit cards should have a utilization rate of less than 30%. When you join Bright Money and set a goal to improve your credit score, Bright will prioritize the credit card with the highest utilization rate to help you bring it down quickly. This is one of the most effective and efficient ways to boost your credit score and is a great option for those who need improvement fast.

Build Savings with Bright Money

Bright Money is equipped with a custom Bright Plan that showcases your Bright goals and a timeframe for reaching each one. The plan focuses on one goal at a time, as well as paying off the highest interest debt and creating a Bright Money savings fund for emergencies.

When you begin using Bright, the algorithm will recommend the order in which you should meet your goals. Typically, paying off high interest credit card debt is top priority. It then takes you through various savings goals:

- Saving for emergencies

- Short-term goals such as vacations

- Investing a custom portion of your monthly income

- Building wealth towards your goal

Bright Money Customer Service Review

If you’re looking for Bright Money customer service, they always have representatives available who are eager to chat or receive feedback. You can contact them via the Bright website’s live chat, by phone at +18568326419, or by email at hello@brightmoney.co

Bright VS Tally

Tally is a financial management app similar to Bright, created to help users get out of credit card debt and meet their payment due dates. While both apps are effective for reaching a debt-free credit card goal, the method behind Tally is more aggressive.

Tally works by giving users with a minimum credit score of 660 a personal line of credit at a lower interest rate than the rest of their debt. With the Tally credit line, users pay off their high interest debt and then pay off their Tally credit.

Another difference between Bright Money and Tally is that Tally is only for getting out of credit card debt. Users who are also looking to build savings and their wealth will not have that opportunity by using Tally.

Frequently Asked Questions

What is the Bright Money Cost?

Bright Money has a few different payment options. Users can pay annually for a cost of about $7 per month, or they can pay monthly for about $15.

Can I Trust Bright?

Bright Money is a legitimate company with a secure platform that uses industry-leader Plaid to connect to your checking account. Through multi-factor authentication, pin numbers, and face scans, you can rest assured that your information and money is safe and secure when you use Bright. Your Bright savings is also FDIC-insured up to $250,000.

Should I Use Bright Money?

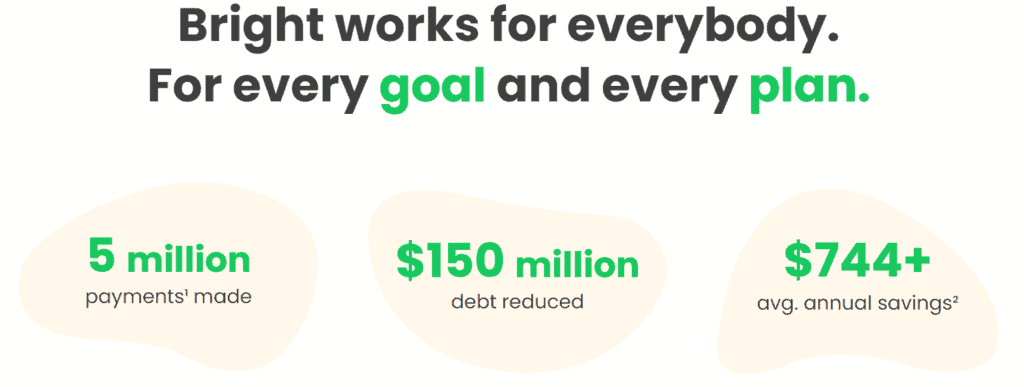

Bright Money is a secure and effective way to reach financial goals such as paying off credit card debt, raising your credit score, and building savings. With more than 500 reviews of Bright on Trustpilot, and a 4.5 star average rating, the company is a great option if you’re looking for an automated way to start on your path to financial freedom. Using AI, Bright helps users pay themselves first in order to prioritize paying debt and investing.

However, if you don’t have high-interest debt and you’ve already begun investing, Bright probably won’t be very helpful for you. For anyone else who is ready to get out of credit card debt and start building wealth, our review of Bright Money concludes that they’re the way to go.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!