Here Are 5 Apps Like SoLo Funds Where You Can Borrow Money

Posted on December 1, 2022 in Loans

It can be difficult to choose a Solo Funds alternative, but hopefully by the end of this article, one of the 5 other apps like Solo Funds below will make more sense for your money borrowing needs.

Table of contents

Ever been in a financial fix but don’t know where to turn to for help? If you find yourself in such a situation, you’re not alone! Over 40% of US households face financial struggles amid the high inflation rates that have seen a rise in the price of products and overall cost of living.

What’s worse is that your friends and family, who seem to be the last resort, might not always come through for you. Payday loans, on their part, are extremely predatory and might lead to a cycle of unending debt.

But those are not the only options you’ve got. Other apps like SoLo funds provide a much better and safer option than taking out a payday loan or other loan to get money. In this article, we’ll discuss what SoLo Funds are, their merits and demerits, and where to get them.

What is SoLo Funds?

SoLo Funds is a legitimate peer-to-peer lending platform that allows individuals to borrow money from their peers. Founded in 2015 by Rodney Williams and Travis Holoway, the company provides a unique way for people to access affordable loans.

They do this by leveraging technology and the power of social networks. In short, they connect lenders with borrowers with peer-to-peer loans.

How Does the SoLo Funds App Work?

Borrowers are always welcome on SoLo Funds. You can request a loan for any purpose: to pay off your credit card debt, cover unexpected expenses, or even purchase a new car. SoLo Funds differs from other peer-to-peer lending sites because it has a “social impact” component.

In addition to helping you get out of debt and make payments on time, you can earn points by paying your loan on time. These points translate into higher SoLo Scores and make it easier to borrow money when you need it the most.

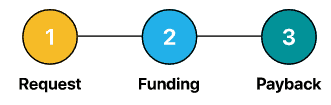

You can apply for a loan on SoLo Funds in 3 easy steps:

- Download the mobile app

- Create an account

- Post your request.

You’ll be able to see all of your lend and borrow requests at once, and users can choose which ones they want to fund.

Once you accept an offer from a lender, you can start paying back their loan at any time — even before it’s due! And if you pay back on time and in full, your SoLo Score will go up, which means you’ll have access to more loans in the future!

What are the Pros and Cons of SoLo Funds?

SoLo Funds is a good lending platform for the right person. Their slogan includes “no judgement, no debt traps.” They understand that borrowing from a friend and or family member can be complicated, and how payday loans and credit cards often result in worse financial situations.

Below are the pros and cons of using the SoLo Funds app you can consider to decide if their loans are perfect for your needs.

The Pros:

1. No credit card is required

You reward yourself with plenty of benefits when you use a lending app like SoLo Funds. For starters, you don’t have to provide any personal information or credit card details to start using the site. You can begin using it immediately without waiting for approval from an administrator or manager. All you have to do to sign up is enter your checking account or banking information. Then, on the app, you can add a new debit card at any time except when your loan is in the Pending Funding or Pending Payback status.

Besides, there are no limits on how much money you can raise on the site. If you need more than $10,000, you’re free to ask for as much as you want. However, it’s worth noting that higher amounts may require more time to fundraise and may be harder for people to donate.

2. User-friendly interface

The SoLo Funds website is designed with ease of use in mind to help launch your campaign without any complications whatsoever. There are also several tools on the website to enable you to plan and manage your campaign better than ever!

3. Quick deposit times

Wondering how long it will take to get a loan from SoLo Funds? Deposits are processed within minutes after making a payment, which is great for those who want the money in their account straight away! This means the entire process from requesting money to receiving it in your account should take about 15 minutes. Many other apps similar to Solo Funds offer quick payment as well.

4. 24/7 customer support team available via live chat, email, or phone call

Their customer support team is always present, ready to help with any issues or queries you may have.

The Cons:

While the idea of a community-based loan might seem like a dream come true, there are some cons to consider before you jump in. They include;

1. Need to explain why you need the cash

The biggest downside of SoLo is that you have to explain why you need the money and how you’ll use it. Most people do not feel comfortable sharing that kind of information with strangers on the internet, in which case exploring apps like Solo Funds below might be a better option. However, if you’re willing to share that information, SoLo can be an excellent choice for your loan and borrowing needs.

2. A lower SoLo score makes it hard to borrow

By failing to pay back a loan on time, a borrower can suffer a decrease in the SoLo score. This makes it more difficult for a borrower to secure future funding.

3. Higher tips to entice lenders

Sometimes, it can be tempting to offer large tips or other incentives to entice lenders into lending you money. Some borrowers end up paying more in tips than they would if they borrowed from a traditional lender, so make sure this doesn’t happen!

5 Similar Apps to Solo Funds Offering Personal & Business Loans

Who says you need to be a bank to offer personal and business loans? Several fintech companies are doing it, and SoLo is one of them. SoLo is a peer-to-peer (P2P) lending platform where people borrow money from other people instead of financial institutions.

The idea behind P2P lending is to match borrowers with investors willing to lend them money at lower interest rates than they would get from a bank. Borrowers get access to the capital they wouldn’t otherwise be able to get, while lenders earn more than they could get in traditional savings accounts or CDs.

If you’re looking for a way to expand your business or fund an upcoming purchase, check out these five incredible loan apps that offer personal and business loans just like SoLo does:

1. Lenme

Lenme is a peer-to-peer lending platform that allows you to borrow up to $25,000. You can apply for a loan in less than 5 minutes and get approved or denied within 24 hours. If approved, the funds will be deposited directly into your bank account in less than a week. You can pay it back over six months or longer at an APR of 11 – 29%.

No credit check is required for these loans, so it doesn’t matter if your credit score is low or nonexistent. Lenme’s no origination fees policy ensures no hidden costs are associated with these loans either!

2. Zirtue

Zirtue is an online platform where you can search and apply for personal and small business loans.

The app is available for Android and iOS users and on desktops via its website. The mobile app allows you to browse through different loan options, check rates on auto or student loans, or apply for a loan by answering questions about yourself that will help you find the best fit.

The application process can take up to 10 minutes, depending on how much information you’re willing to share with Zirtue to qualify for your desired loan (the minimum amount is $1,000).

You can borrow between $1,000 and $30,000 through this service. However, keep in mind that if you are approved by one of the partner lenders, they may require additional verification documents before issuing a decision on your loan request.

3. Hundy

Hundy is a peer-to-peer lending app that lets you borrow money from your friends, family, and community. You can borrow up to $50,000 at an interest rate of 5.99% per year—less than half the rate of a typical credit card or personal loan.

Hundy provides an easy way to get a small personal loan without providing extensive documentation, like in traditional banks and other lenders. All you need is a little information about yourself to help Hundy verify your identity, employment history, and financial standing. The entire application process takes less than five minutes!

4. Prosper: Personal Loan

Prosper is a peer-to-peer lending marketplace that connects investors who want to earn higher returns on their money with borrowers who need it. The site operates in the United States, Canada, and the United Kingdom, where you can borrow or lend money to other individuals.

Prosper’s main advantage is that it offers low-interest rates on loans—as long as you can find a willing lender (and vice versa). Your credit score doesn’t affect your ability to get approved for a loan via Prosper. What matters most is how much money you’re willing to part with as collateral.

Prosper offers some high-risk loans with a high interest rates compared to others, such as personal lines of credit or unsecured personal loans without collateral. These are available only through their “VIP” program.

As with most other peer-to-peer lending sites and apps like SoLo Funds, using Prosper requires an account and identity verification before applying for a loan.

5. Topcheck

If you have a good credit score and want to borrow money, Topcheck is a great place to get a personal loan. With Topcheck, you can borrow money from people willing to lend their hard-earned cash—and their trust in your ability to pay it back on time.

When you apply with Topcheck, your loan amount is determined based on the amount of money the lender has invested in the platform (up to $10 million). Once that number is determined, Topcheck will give you an interest rate and determine how much of your income should go toward paying off your debt each month.

Conclusion on Apps Like SoLo Funds

We hope you found the right app for your borrowing needs from our article on five apps like SoLo Funds. Similar to the best cash advance apps, these apps are a great place to start if you’re interested in borrowing money for personal use or boosting your business. Just be sure to read the fine print and understand each platform’s terms before signing up.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!