Retake My Credit Credit Monitoring Review 2023

Posted on May 10, 2022 in Money

Your credit history is the most important aspect of your financial life. It determines everything from whether you get approved for a loan to what interest rate you receive. That’s why we’re here today to walk you through a comprehensive review of Retake My Credit.

Table of contents

- Who is Retake My Credit?

- A Review of Retake My Credit Wellness Services:

- Retake My Credit Program Options:

- How Retake My Credit Works

- Step 1: You’ll sign up for services through their partner and receive a login for your portal. View your scores and reports as you please.

- Step 2: 24/7 credit monitoring starts immediately with updated alerts and $1 million identity fraud insurance.

- Step 3: Proactive monthly audits search for items that negatively impact your credit score while their agents flag those items for potential disputing.

- Step 4: All disputable items are handled by a consumer law practice with 20 years of experience in the credit space.

- Step 5: Start building your credit score through education. Clients have access to their interactive tools to understand better the factors that impact their credit.

- What are the Benefits of Retake My Credit Services to Individuals?

- How poor credit can cost a consumer more money

- A Final Review of Retake My Credit

Did you know that around 80% of credit reports contain errors? Credit bureaus compile your credit report based on information from lenders, and their reports don’t always reflect reality. That’s why it’s so imperative to check your credit report regularly to make sure it’s accurate and up to date, and that’s just one reason why Retake My Credit is worth a review.

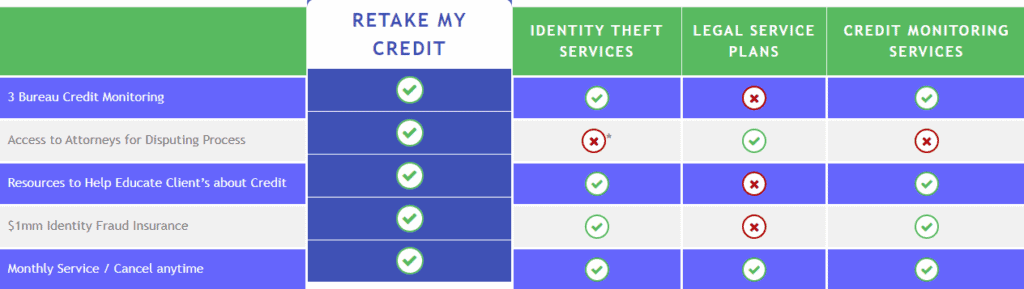

While some companies will assist you in removing negative items from your credit report, others will only provide monitoring. A review of Retake My Credit reveals that it is a one-stop shop for all things credit wellness, giving them a significant advantage over the competition. In this post, we’ll go over this newer company’s credit wellness services in detail, including why you might be able to stop your search for the best credit health and monitoring service here.

Who is Retake My Credit?

Retake My Credit is credit monitoring with a purpose. The company specializes in assisting customers in improving their credit scores. They have professionals that take the guesswork out of working with the credit bureaus and creditors.

A Review of Retake My Credit Wellness Services:

Retake My Credit is a one-stop shop for credit wellness. You can get all the credit services you need under one roof, so you don’t have to bounce between different companies for each service. Additionally, Retake My Credit has several key advantages over many of its competitors.

Here are some of the things they do:

Credit Monitoring

As a consumer, you deserve to know what’s going on with your credit because your credit score affects your financial situation. Unfortunately, most people are not always aware of their credit standing until too late. Lucky for you, there’s Retake My Credit. The company helps monitor your credit and ensure it stays in good standing.

Retake My Credit tracks your credit score, credit report, and credit activity. In addition, they offer a monthly report and email alerts to inform you of any major changes to your score or report. The company will also send instant action alerts to your phone so you can stop credit breaches immediately before they become a problem.

The company also offers a $1 million identity fraud insurance policy that helps cover the costs of

recovering from identity theft.

Credit Report Auditing

Retake My Credit audits your full credit report (all 3 bureaus) every month to proactively identify errors or items that don’t belong. If their software detects an irregularity, it’s flagged and sent to dispute. So, Retake My Credit catches errors before you do which helps keep your credit file clean.

Credit Disputing

Disputing any inaccurate information on your credit report is vital to raising your credit score. This practice can be time-consuming and tedious, but Retake My Credit handles every step.

Also, all disputes are handled by consumer protection attorneys with over 20 years of experience. When you choose Retake My Credit for total credit wellness, you have true professionals handling your file.

Credit Education

One of the most valuable services Retake My Credit offers is credit education. If you need help understanding how your credit score works and what you can do to improve it, a representative will be happy to walk you through the system and explain everything. Finally, every client gets their own personal portal with interactive tools that help you build your credit score.

Retake My Credit Program Options:

Retake My Credit offers two programs:

1. Individual Program

If you need help building your credit and are looking for a program that will work, you can check out the individual program provided by Retake My Credit.

Another reason to use this service is that the company will give you a free consultation before you sign up. The representative will also help you develop an action plan so your credit profile is protected for the long-term and you can achieve the credit score you desire.

2. Employer Program

Retake My Credit can help firms boost their employees’ financial awareness and credit profile, making a big difference in their lives. The employer program is beneficial to companies with low- and moderate-wage workers who may not have the resources or knowledge to tackle their credit problems independently.

Some benefits of providing the employer program to your employees include:

- It will help retain top talent at your company.

- Along with being an attractive benefit for potential employees, the Retake My Credit’s Employer Program is also great for keeping your current team happy and loyal to the company. Paying attention to employees’ credit scores shows that you care about them as people, not just workers. Ultimately, it strengthens their bonds and makes everyone feel good about working together.

- Employees are less likely to miss work due to financial stress.

- Financial stress is a major reason for absenteeism at work and one of the greatest drains on productivity. Helping employees get their finances under control makes for happier, healthier workers who are more focused on doing their jobs well than dealing with personal problems.

- Your employees will feel better about themselves.

- Low credit scores can embarrass and make people feel like failures. By offering a program like Retake My Credit, you’re showing your employees that you care about them as individuals and want to help them move forward in their lives. This type of support will earn you their trust and gratitude, translating into more loyalty and increased effort on the job.

How Retake My Credit Works

After a review of Retake My Credit it becomes clear that their process is a bit different; they have a proactive approach to credit wellness. The firm has developed a process that focuses on the clients and the results they want.

They make sure that each step of the process is fully explained and provide you with access to tools that will enable you to understand how your credit score is affected by different factors. Here’s what you can expect:

Step 1: You’ll sign up for services through their partner and receive a login for your portal. View your scores and reports as you please.

Step 2: 24/7 credit monitoring starts immediately with updated alerts and $1 million identity fraud insurance.

Step 3: Proactive monthly audits search for items that negatively impact your credit score while their agents flag those items for potential disputing.

Step 4: All disputable items are handled by a consumer law practice with 20 years of experience in the credit space.

Step 5: Start building your credit score through education. Clients have access to their interactive tools to understand better the factors that impact their credit.

What are the Benefits of Retake My Credit Services to Individuals?

Peace of mind

When using Retake My Credit as your credit monitoring company, you will receive an email notification every time there is a change in your credit report. This allows you to keep track of any changes in your credit score and address any errors or issues before they have time to impact your life negatively.

Monitoring

They monitor your credit report in real-time, 24/7 so that you can be more proactive by allowing them to handle matters as they come up. This will enable you to see what’s on your credit report at any given moment and enable you to get instant help in case there’s something that needs fixing.

Legal team

One of the most important benefits of using Retake my credit is their dedicated legal team that works alongside their credit wellness specialists. The legal team is experienced in the field and uses proven strategies to help improve their clients’ credit reports. They’ve worked in this space for years, so you can rest assured that your case will be handled with great care.

Cost-Benefit

Lower rates are possible if you have a good credit score. People will save money on their monthly bills due to this. The cost savings may not seem like much at first glance, but the cumulative effect over time could be significant. It may take some time for a person’s score to increase and then receive lower rates, but it is worth it.

Confidence

Retake My Credit has a team of credit experts who have worked with all types of credit issues. The team understands that life can sometimes get in the way and can mess up your credit. As such, they are on your side and work hard to find the best solution for you.

How poor credit can cost a consumer more money

There are numerous factors that determine your credit score. Your credit utilization ratio, payment history, and length of time with current accounts are all big factors. But on top of all this, one often-forgotten factor is the simple truth that a lower score can cost you more money in interest rates when you’re borrowing funds.

Credit scores are the main way lenders determine whether you’re a good candidate for their loans. And if they decide to extend you credit, they’ll do so at a rate that reflects how risky they

think you are. This means that the lower your credit score is, the higher your interest rate will be—and this difference can be significant over years of repayment.

Here’s an example: An individual in the 600-619 FICO range might pay a ~10% higher rate than someone in the 660-679 FICO range. So for a $30,000 car loan spread over three years at 5%, this would mean an extra ~$2,700 in interest payments—nearly $3,000 more over the life of the loan just to have a poor credit score! Even having a 650 vs. 670 score could cost someone ~$1500 more.

A Final Review of Retake My Credit

Life can be complex and full of unforeseen twists and turns. Sometimes, those unexpected events cause us to lose track of our credit, resulting in negative marks that can haunt us for years.

Retake My Credit is designed to help you do just that: take back control of your credit score. By following their one-of-a-kind system and actively monitoring your progress over time, you’ll finally get the credit score you deserve. If you’re ready to start with Retake My Credit, you can easily sign up online through their website.

Related: See how Retake My Credit compares to Credit Saint.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!