5 Payday Loan Relief Programs

Posted on November 15, 2022 in Debt

The best payday loan relief programs include consolidation loans, settlement, and other credit counseling options from 5 top companies that we explore here.

- What Is A Payday Loan?

- The Benefits Of a Payday Loan

- The Downside Of Payday Loans

- What Is A Payday Loan Relief Program?

- The 5 Best Payday Loan Relief Programs

- Final Thoughts on Payday Loan Relief Programs

Payday loans have been the subject of debate in various social and economic circles for some time. Love them or hate them, these short-term, high-interest loans are a part of our complex financial system. So let’s take a deeper look at what payday loans are, what purpose they serve, and how to manage payday loan debt responsibly.

What Is A Payday Loan?

Let’s start by exploring what a payday loan actually is. Payday loans are often marketed as a short-term loan alternative to those who are in need of quick cash for bills or unexpected expenses in between paychecks. These short-term loans allow borrowers to gain access to funds ranging from a couple hundred to a few thousand dollars without the need for the lengthy credit and income checks required by traditional lenders. A payday loan company may require no collateral or may be secured by the borrower’s car title or other valuable assets.

These short-term loans often carry high-interest rates and are intended to be paid back in full within a short period of time, usually less than 30 days. If the borrower is unable to repay the loan at the agreed-upon date, the loan can generally be rolled over by paying an additional fee.

Payday loans are popular as a means to pay bills and unexpected expenses between paychecks. The most recent statistics report that approximately 12 million Americans use payday loans to meet their financial obligations each year, with as much as 75% of these loans being acquired by repeat borrowers. That said, there are many pros and cons of payday loan offerings to understand, and we discuss these benefits and downsides more below.

The Benefits Of a Payday Loan

Payday loans offer a way of obtaining quick cash in an emergency. They can seem like the perfect option when you have a bill that must be paid, a car that needs to be repaired, an emergency medical visit, or some other unexpected expense, and your next paycheck is still a week away. Payday loan providers offer an alternative to traditional loans, allowing consumers to borrow small sums of money, generally between $500 to $5000 with an agreement to repay the loan on the date of their next payday.

While traditional lending institutions often require extensive credit checks, and proof of income before providing funding, most payday lenders require only the bare minimum of identification and income verification documents. While some payday loan providers may require some form of security like a car title, or other valuable assets, most will issue short-term payday loans with a simple signature on the contract.

The Downside Of Payday Loans

Of course, as the saying goes, “if something sounds too good to be true it probably is”. This certainly holds true with payday loans. While the ability to obtain quick easy cash with little to no questions asked certainly sounds wonderful, there is a catch.

The privilege of receiving these short-term cash infusions generally comes at a daily high overall cost to the borrower. For starters, the interest rate on short-term payday loans is often much higher than the interest rates offered in traditional loan products. Regulations have been implemented in recent decades to attempt to limit the exorbitant interest rates assessed by short-term loan providers, however, even with these caps in place the interest rates are still far higher than one would pay for other types of lending.

The payday lenders argue that these high-interest rates are not an issue because the length of the loan period is so short. Here is the catch. While the loan period is very short, the loan terms are fairly strict. Most payday loans require that the borrower repay the full amount borrowed plus any interest accrued, and any borrowing fees in order to satisfy their loan debt.

In many cases, the loan fees and accrued interest balloon the final payment to a total that is too high for the borrower to pay out of one paycheck. The payday loan provider then offers the borrower a new alternative. Simply use your paycheck to pay off the existing loan, and immediately receive a new loan to cover your expenses until your next pay period. This is commonly referred to as rolling over the payday loan, and this practice commonly traps borrowers in a never ending cycle of repaying one loan, and immediately needing to obtain another, trapping them in a cycle of constant debt.

What Is A Payday Loan Relief Program?

Payday loan relief programs throw consumers a lifeline by offering them a way to escape the endless cycle of debt that is the payday loan trap. If you’re asking how to stop payday loans from debiting my account, or just searching for a way to break the cycle, you’re in the right place.

Payday loan relief programs work in a few different ways. Some payday loan relief programs work directly with payday lenders to advocate for consumers and help them to reduce their interest rates and establish more reasonable repayment terms. Other payday loan relief programs aid consumers by paying off the payday loan debt and issuing a new loan to the consumer with reasonable interest rates and repayment terms.

Both types of programs are designed to aid consumers in breaking free from the payday loan cycle, however, it is important to do adequate background research and ensure that you are selecting the right payday loan relief program for your financial scenario.

If you feel like you’re in over your head with payday loans, take a look at the following top 5 payday loan relief programs available now.

The 5 Best Payday Loan Relief Programs

1. TurboDebt Relief

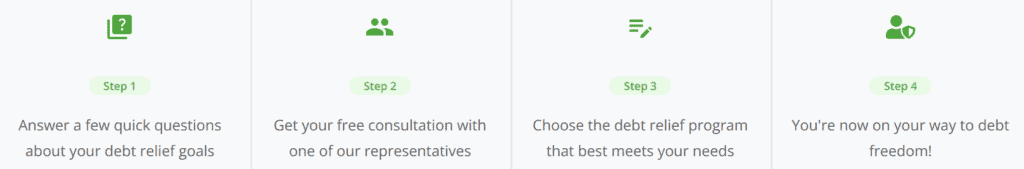

TurboDebt Relief is our top pick because it offers the widest range of payday loan debt relief solutions all under one roof. The TurboDebt Relief professionals work with consumers to understand their debt relief needs and then connect them with the most effective payday loan debt relief program for their unique financial situation.

TurboDebt Relief understands that every borrower is unique, and every situation with unsecured debt, such as a payday loan is different. A one-size-fits-all approach to debt relief often leaves many borrowers further in debt than they started. This is why TurboDebt Relief works with each individual borrower to understand their specific financial scenario and to craft the right payday loan relief solution to best meet their needs.

TurboDebt Relief offers an array of consolidation and repayment options all designed to help borrowers free themselves from the payday loan trap and restore their financial freedom. This personalized approach to debt consolidation, and debt management has made TurboDebt Relief the #1 Debt Relief program on Trustpilot with a 5-Star rating backed up by over 3000 positive reviews from happy, debt-free clients.

2. DebtHammer

DebtHammer is a payday loan relief advocacy program that has cultivated a working relationship with several payday lenders allowing DebtHammer to exercise considerable influence in helping consumers of these companies get out from under their high-interest payday loan debt.

DebtHammer operates by reaching out to select payday lenders on behalf of their clients and making it known that they will be representing the client. DebtHammer will generally put an immediate stop to automatic withdrawal efforts, and collection calls from the payday lender. They will then work with the borrower to establish a 12-month repayment plan with lower interest rates, and an affordable monthly payment.

3. Real PDL Help

Real PDL Help is a payday loan relief advocacy program that represents the interests of the borrower to the payday lender. Real PDL Help offers a free consultation to assess consumer debt, and the ability to pay. They will then work with the borrower to establish bi-weekly or monthly payments made directly to Real PDL Help. Real PDL Help will then pass those payments on to the lender.

Once guaranteed payment, the payday lender is generally encouraged to cease all collection efforts. Real PDL Help will also help to stop payday lenders from taking automatic payment withdrawals from the borrowers’ bank account restoring control over your finances.

4. InCharge Debt Solutions

InCharge Debt Solutions does not specialize in payday loans specifically. That being said, the company is a 501C non-profit debt relief and debt counseling agency that can provide a great deal of help to consumers struggling to free themselves from all types of outstanding debt, including payday loan debt.

InCharge Debt Solutions offers borrower advocacy and consumer education to aid borrowers in negotiating successfully with payday lenders to secure more favorable interest rates and debt repayment terms. The company has a proven record of helping consumers navigate payday loan relief with state law in mind.

5. Lending Club

LendingClub is a unique payday loan relief option, offering qualified borrowers the ability to receive payday loan debt consolidation from a network of private lenders on a peer-to-peer lending network. These personal loan alternatives often carry lower interest rates and better repayment terms than traditional debt consolidation loans, and they will certainly have far lower interest rates and better terms than those offered by the payday lender themselves.

Because LendingClub is a private peer-to-peer lending network, the vetting process can be fairly strict. A credit check is required, and consumers with a FICO credit score below 650 are unlikely to find a willing lender. This makes LendingClub a solid option for payday loan borrowers with solid credit but puts it out of reach for most payday loan customers.

Final Thoughts on Payday Loan Relief Programs

While there is no one-size-fits-all payday loan relief solution, these 5 options represent the most effective, and affordable ways how to get out of a payday loan and find relief. Regardless of the solution you choose, you owe it to yourself to seek out qualified help to aid you in escaping the insidious payday loan debt trap. Put yourself back on the road to a stress-free life of financial freedom today.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!