OppLoans Review: Fast Installment Loans Online for Bad Credit

Posted on April 26, 2021 in Loans

Are you in need of an alternative loan solution?

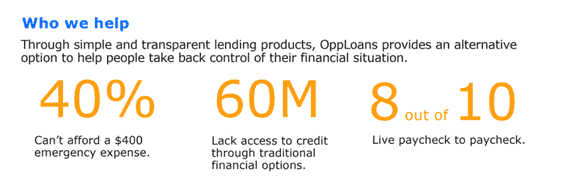

You may want to consider a review of OppLoans who has helped people take back control of their financial situation. Particularly those who can’t afford a $400 emergency expense, people who lack access to credit through traditional financial options, and for workers living paycheck to paycheck.

What is OppLoans? A Review:

OppLoans is an installment loan company that offers fast funding options for people with bad credit. The loans offered through the OppLoans platform are unsecured, with high interest rates and in most states are made by a bank partner. With loan terms that can last from 9 to 18 months4, the company is not a payday loan provider. Instead, they are a doable option for people with bad credit who need a loan fast and are unable to obtain one with less interest.

Applying for a loan on the OppLoans platform will not affect your FICO as their lenders utilize alternative credit scores to determine your creditworthiness and ability to repay. However, OppLoans does have excessively high interest rates, so borrowers must be certain of their ability to repay when applying.

While the high interest rates offered through OppLoans platform means they may not be right for everyone, they are a good small loan option for those with poor FICO scores, and have a number of features that ensure the consumer is put first.

Consumer-First Features

OppLoans focuses on making sure the consumer is first. With consumer-friendly features that make it simple for qualified individuals to obtain a small loan, OppLoans can be extremely beneficial for those with certain financial circumstances.

A review of the consumer-first features of OppLoans include:

- Applying Does Not Impact FICO

- Bad Credit-Friendly – No Minimum FICO Score

- Fast Loans- Same-day Funding Available

- Associated Disclosure: Subject to credit approval and verification. Actual approved loan amount and terms are dependent on standard underwriting guidelines and credit policies. Funds may be deposited for delivery to your bank via ACH as soon as the same business day if verification is completed and final approval occurs before 12:00 PM CT on a business day. If approval occurs after 12:00 PM CT on a business day or on a non-business day, funds may be delivered as soon as the next business day. Availability of the funds is dependent on how quickly your bank processes the transaction.

- No Fees for Loan Prepayment- Pay Off Early if Possible

- Financial Education- Learn How to Build Credit and Make Beneficial Financial Decisions

- Credit History Impact- Reports Regularly to Top Three Credit Bureaus: Transunion, Equifax, and Experian. On-time payments may increase your credit score.

These features are essential for bad credit borrowers. People who have an extreme financial situation can receive the funds they need in as little as one business day.

How Does OppLoans Work?

OppLoans offers people with bad credit a simple way to obtain a small loan. These installment loans are more beneficial to consumers than payday loans, as they tend to offer longer repayment terms and a lower interest rate than some payday loan lenders. You don’t want to get into a situation where you’re asking, “how can I block payday loans from debiting my account.”

With an installment loan through OppLoans, approved borrowers can receive needed funds within 1-2 business days from approval. Payments are set up to be made on a regular schedule until the loan is paid in full. Through the duration of the loan, payments are reported to the credit bureaus, which may help bad credit consumers build their credit.

Details

Applicants may apply for small-dollar loans through the OppLoans platform. While they have extremely high interest rates, they may be a great choice for people who cannot obtain a less costly loan. There are no origination fees and no late fees, which are both very important features for people considering taking out a high-interest loan.

Interest rates on OppLoans are at 160%-179% APR across all states The maximum amount of funds offered through OppLoans is $4,000, making it a great choice for people who need a small loan right away.

Requirements of OppLoans to Review

When people apply for loans through the OppLoans platform, they will not be disqualified due to a poor FICO score. However, there are a number of requirements that borrowers should be aware of that lenders on the OppLoans platform typically look at, including:

- $1,500 Gross Monthly Income in most states

- Regular Monthly Income- Employment, Benefits

- Established Bank Account

- Paid via direct deposit in most states

- Residence in a state OppLoans operates in. A list of states can be found on their website

- Age of majority in state of residence. In most states, this is often 18 years old.

OppLoans Application Review

Apply online for an OppLoans installment loan. It’s fast, simple, and secure. When you begin the online application, make sure you’re prepared with the necessary information:

- Name

- Address

- Phone Number

- Birthday

- Social Security Number

- Type of Income (i.e. Employment, Benefits)

- Method of Income (I.e. Direct Deposit, Manual Deposit)

- Monthly Income

- Frequency of Income

- All Banking Details

Follow the online instructions, entering all of the essential information as you are prompted.

Fill out a fast and easy online application in minutes!

The OppLoans online application process is an easy way to get money fast if approved.

Verify Income

Securely connect your bank account to your loan application. Your application will be verifiable by the information retrieved from your bank account.

Review Agreement

Review and accept your loan’s repayment agreement. Read over the agreement and make sure you can and will adhere to all of the terms before you accept. Note that this does not constitute approval and additional verification may be performed after this step.

How Long Does It Take To Get A Final Decision?

You will be provided a decision on your installment loan application quickly! Reviews of OppLoans show most consumers receive a final decision within a day, though it may take longer. If you are approved, you will receive funds within 1-2 business days following approval.

OppLoans Sign-In

Easily sign-in to your OppLoans account to receive essential information about your application, loan, and payments.

OppLoans Interest Rates

While the interest rates can be considered high, they are smaller than most payday loans. The APR often depends on the state of the borrower. Rates can be 59% to 160%.

Loan Example

Take a look at this example of an OppLoans installment loan:

- Borrower makes $45,000 a year

- They borrow $1,350 from OppLoans, Repayment Term 9 months, 160% APR

- Monthly Payments Set Up for $266.34 Per Month

- Interest on Loan will be $1,047.07

- Overall, the borrower will spend $2,397.07

Is OppLoans Legit?

OppLoans has a high BBB ranking, one of the sure signs of business legitimacy. The company empowers credit access for the 60 million Americans who are locked out of traditional financial products. Borrowers receive their funds deposited directly into their bank accounts quickly, within 1-2 bussiness days. Funds are available for borrowers to use as needed.

When to Choose OppLoans: A Final Review

Due to the high interest rate associated with OppLoans, these fast small loans may not be the best choice for all. However, depending on financial circumstances, OppLoans may be exactly what the consumer needs to get ahead.

Our OppLoans review shows that it is a great choice for people in certain financial situations, such as:

- Bad Credit

- Need Money Right Away

- Want to Avoid the Higher Interest Rates of Payday Loans

- Will be Able to Pay Loan Off Quickly – No Penalties for Repayment

Apply For A Loan Today Through OppLoans!

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!