Debt Relief For Maryland Residents

Posted on March 9, 2022 in Debt

If you’re overwhelmed by debt, know that you’re not alone — in fact, the average Maryland resident’s credit card debt alone is nearly $10,000. TurboDebt is here to help Maryland residents find debt relief, and we take great pride when our customers can pay off their credit cards or get approved for a loan because of our services. Since our start as a company, our goal has been to get our clients out of debt through strategic planning, advising, and consulting, and to build wonderful and lasting relationships along the way. Learn more about how we can help you achieve debt relief in Maryland below.

Table of contents

Financial Literacy Helps Consumers Leave Debt Behind

At TurboDebt, we believe that educating consumers is the best way to prevent falling into the trap of debt. We inform people of all ages about the perils of being in debt and how they can build a solid financial foundation while remaining above water. We know that not everyone is set up for success, and that’s why we are here to assist those who find themselves in need of help with debt relief in Maryland.

Our experienced representatives are well versed and up to date on the financial rules and policies that can make the biggest difference to your situation, and help you start your journey to a debt-free life. It is our mission to treat each and every customer with compassion and understanding. While many of our customers have similar problems, we know that your situation is unique and when you seek debt relief in Maryland from TurboDebt, you’ll receive individualized care designed to meet your needs.

COVID-19 Pandemic Means Tougher Financial Landscape for Maryland Residents

While it’s been two years since the onset of the pandemic, the lasting impacts are still being felt by workers who are looking to return to work in these different times. Unemployment claims in Maryland spiked in March of 2020, and the economy has yet to recover. Lifestyles and viewpoints around work have changed, which can make it harder to secure gainful employment, and can send people further and further into debt along the way. Workers searching for new positions are finding it hard to meet their needs with current openings, and complain of:

- Lower salaries

- Slow hiring page

- Lack of accessible and affordable childcare

- Little flexibility

- Fewer benefits

All of this is to say that many workers are living off of savings or government assistance, which makes it difficult if not impossible to save money over time.

Maryland Credit Card Debt By The Numbers

The average household credit card debt in Maryland in 2018 was under $8,000. In 2020, it had shot up to $9,368. While the entire country is facing similar issues, Maryland ranks 18th when it comes to average household credit card debt. Because credit card debt is common, it can make it seem more manageable and simply a part of life. However, unless paid in full each month, credit card debt can become more expensive over time, and take years to pay off. Rather than living with a cloud hanging over you, taking small, strategic steps toward paying off your debt will make a big difference in the end.

Other types of debt facing Maryland residents include:

- Student Loan Debt: Student loans can become a crushing burden to those who are unable to earn enough money to pay them off regularly. Maryland ranks eighth in the United States in terms of student loan debt, with an average of $32,165 in student debt per person.

- Auto Loan Debt: Maryland ranks in the middle of the line compared to other states in this arena, with an average auto loan debt of nearly $20,000.

- Mortgage Debt: The average mortgage debt in Maryland is $249,472. This is a significantly higher figure than the national average because it is influenced by the fact that many of the state’s wealthy suburbs are located just outside of Washington, D.C, in Maryland and Virginia.

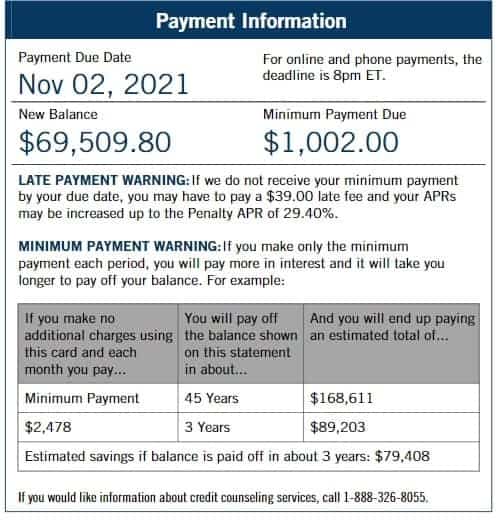

Example of How Debt Relief in Maryland Can Save you Money:

Debt Relief Options for Maryland Residents

TurboDebt is among the top debt counseling services offered in Maryland. With our years of experience and expertise in debt management, our team can guide you through debt relief and credit counseling options. We can even work with your creditors in order to consolidate your debt and create a more affordable monthly payment plan. There are many steps you can take to put you on the path to achieve success with debt relief in Maryland, and make it easier not to fall behind again.

Make sure to reach out for a free consultation with TurboDebt today. For more resources and debt solutions to help you achieve relief, here are some assistance programs available to Maryland residents:

- Debt Consolidation Loans: Maintaining a good credit score may make you eligible for a debt consolidation loan. This is a low-interest loan that allows you to pay off your higher interest credit card debt. It does require a strong credit report, as well as good planning and organization to save you time and money.

- Debt Settlement: If you are struggling to make even the minimum payment on your credit card debt, a debt settlement plan may be a good option for you. This involves the credit card company agreeing to accept less than what is initially owed, either in a lump sum or over time. While this plan is helpful to a certain group of people, it can negatively impact your credit score in the long-term, and should only be considered in more severe cases.

- Do It Yourself: TurboDebt can be of assistance in designing a personalized plan for your debt management program. DIY programs may use a combination of tools in order to best fit your personal financial situation.

- Bankruptcy: While filing for bankruptcy will wipe out your credit card debt, it is not often the first choice for people struggling with debt. This is because it will negatively impact your credit score for 7-10 years. Any hopes of becoming a homeowner or getting a substantial loan will become much more difficult to fulfill. This is why most advisors would leave this option as a final step to achieve debt relief in Maryland when other alternatives have failed.

Finding the Right Debt Relief Representative in Maryland

We believe that consumers should take as cautious an approach as they can when it comes to seeking debt relief programs and services in Maryland. Because there are many predatory businesses that may try to take advantage of people in financial distress, it’s important to be wary and find experienced and trustworthy professionals to assist you on your journey to debt relief. For this reason, if you find a deal that appears too good to be true, it’s likely that it is. Debt relief does not happen overnight and it is certainly not a one-size-fits-all solution. TurboDebt’s three-pronged approach specializes in

- Strategic Planning to find the best plan to become debt free in the shortest amount of time,

- Advising clients on how to balance priorities and break free of the debt cycle, and

- Consulting services using our insights and skills to transform these strategies into a manageable game plan for security and stability.

Our knowledge base and access to resources ensures that our clients have a practical roadmap to secure a debt-free future. It won’t be easy, but with the right help, a debt-free life is possible for you.

Take Control Of Your Financial Future With Debt Relief in Maryland

TurboDebt offers debt relief information and resources so that you can take control of your finances. This includes helping you with debt recovery in implementing effective strategies and low cost solutions to alleviate debt.

People need to have choices, time, and options when it comes to managing debt. TurboDebt connects clients to Maryland specific debt relief programs that fit their unique needs. If you’re looking for low-income assistance in Baltimore, Frederick, Rockville, Gaithersburg, or anywhere else in Maryland, TurboDebt can help you find the best solutions for your personal situation. Debt relief exists and we can help you get there. You are not alone in your struggles or your goal to live debt-free. For a free consultation, reach out today.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!