Alternatives to Bankruptcy: Find Other Solutions Today

Posted on September 14, 2022 in Debt

This article will teach you about alternatives solutions to bankruptcy, including debt relief options such as debt management, settlement, and consolidation. Filing for bankruptcy or obtaining another loan should be your last resort before trying an alternative, so do your research because there are several other proven options to eliminate debt that we discuss below.

Table of contents

Coming out of a two-year pandemic that shut down the entire country with no end in sight has left many people with mounting bills and seemingly insurmountable debt.

According to a CNBC report, the average American in 2021 had $90,460 in debt.

The unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April of 2020.

Even though today we see some serious recovery in our economy, those kinds of numbers are hard to come back from.

Sure, maybe you have a job again, but the debt that piled up during those times you didn’t, or your spouse didn’t, does not disappear as soon as you get back to work.

Considering Bankruptcy: What to Know

So, you may be considering bankruptcy based on your current financial situation.

And really, who can blame you?

Bankruptcy is a perfectly reasonable solution for millions of people each year who simply cannot afford to get on top of their debt.

Maybe you’ve tried everything; you’ve met with credit counselors, you’ve contacted your creditors, you’ve taken a second job, and you just feel defeated.

Bankruptcy, for many people, is the final solution and one that finally allows you to get back to the business of living again.

Whether you file Chapter 7 or Chapter 13, paying some of your debt off or clearing it away entirely, bankruptcy could be the only thing that allows you to keep your home, your car, or a roof over your head.

Some hardworking people get hit with medical bills that are impossible to pay in a lifetime.

Others suffer the loss of a loved one who was also a financial provider in the household.

The bottom line is that sometimes bankruptcy really is the only option, and we fully support you if that’s the case. Speak with a good bankruptcy lawyer, and you can finally get that sense of freedom back into your life.

Of course, as with everything, there is a downside to bankruptcy.

Your credit score will take an immediate hit, dropping by 100 points or more.

Lenders will be less likely to give you a line of credit right away, and even for years afterwards.

It will be more difficult to buy a car or a home for months to years after bankruptcy.

And in this day and age of information, employers may be more hesitant to hire someone who has filed bankruptcy.

It really will take time and effort to build back your life after filing bankruptcy.

All of which is to say that you do have alternatives to bankruptcy, and if you have not explored them all, we want you to know that you are not alone, that we have resources to help you, and that freedom is just around the corner, with or without bankruptcy.

Alternatives to Bankruptcy

You may be asking yourself, how can I get out of debt without filing bankruptcy? If this is the case, our top alternatives to filing for bankruptcy are listed below to assist you.

Debt Settlement

One commonly used alternative to bankruptcy is debt settlement. In this instance, you will find a debt relief company that will contact your creditors on your behalf and negotiate down your total amount due. For example, if you owe $50,000, the debt relief company may negotiate it down to $10,000. The benefit to the creditor is that at least they get some money out of the deal.

When you work with a debt relief company, they will take all of your information and set up an escrow bank account for you. You will pay weekly or monthly payments to the company and the money will accrue in that account. Then, the company will make payments for you to the creditor.

Note that debt settlement usually negatively affects your credit score as your creditors go months without being paid while your money accrues in escrow, and they report your late fees to the credit agencies. Ultimately, your debt will be settled or “charged off” on your credit report, which is negative.

Be mindful that there are some very unsavory debt settlement companies out there who do bad business, mishandle funds, and make promises they cannot keep. They may also charge high fees in addition to your repayment plan.

So be sure to do your due diligence, check online reviews of the company, and compare rates and performance before you commit to debt settlement as a way to avoid bankruptcy.

Debt Management

Debt management involves working with a credit or debt counseling center that sits down with you, reviews all of your credit, expenses, and incomes, and negotiating with your creditors on fees and interest rates, ideally saving you money in the long term on your payoffs.

They will also send up a monthly budget for you, and tell you that it is a simple process of in and out, income and expenses, and keeping track accordingly.

Be aware that often credit counseling agencies can charges as many fees as they end up saving you, so unless you really do need credit counseling, in terms of tips on how to budget your funds, this might not be the best option.

Debt Payoff Planning

An alternative to debt management plans with a credit counselor is to use an app that does all that for you.

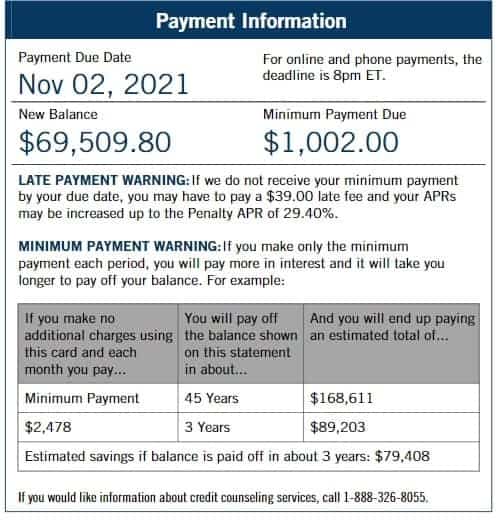

Savvy Debt Payoff Planner will allow you to add your bank accounts and creditors and help you set up a plan for payoff, encouraging throughout the process and updating your payoff amounts each time you make a payment. For example, see the image below of someone who only payed the minimum payment compared to how much quicker you’d be debt free by paying off more per month.

Debt Snowball

Debt snowballing means you list all of your debts from smallest amount to largest amount and then pay off your smallest debt first. Once you do, you take the amount you were paying to your smallest debt and apply it to the next smallest debt and so on until all debts are paid off.

Debt Avalanche

Compared to the debt snowball approach, the avalanche method starts with having you list all of your debts from largest interest to smallest interest debt. You start paying all of your debts using only minimum payments, and then each time you pay one off, you take that monthly payment and apply it to the debt with the highest interest, and so on until you’re all paid off.

Home Co-Investment

Home co-investment involves working with a lending company to “invest” in your home for a share of equity in your home. Then, when you sell your home, that company will get the agreed upon equity.

The benefit of this is that you can use that “investment” loan to payoff your debt, and that investment is not considered a debt.

For example, read our review of Unlock, a real estate investor who pays you a lump sum of cash in exchange for a percentage of the equity in your home.

Debt Consolidation Loan

If you are not eligible for home co-investment, or don’t want to use your house as collateral, you can always take out a debt consolidation loan, which simply combines all of your debt into one payment.

Quite often, you can end up saving money over time on the interest rate, and you won’t have to keep track of multiple payments each month.

Even better, it won’t show up as a negative on your credit report. On the contrary, it can even improve your credit score as you make payments on time.

Mortgage Refinancing

With enough equity in your home, mortgage refinancing to pay off your debt can be a great idea.

Typically, mortgage loans are the lowest rates on the market, and your payments will be spread out over the life of your mortgage, making it much more manageable than paying off those credit cards or medical bills to collection agencies.

Increasing Income

In the day and age of the side hustle, adding a little extra income can be a great option to pay off debt.

You can pick up some freelance work on platforms like Fiverr or Upwork, or you can start driving for Uber or Lift.

Anything to bring in a few extra hundred dollars a month that you can pay right into your loans will help.

And hey, you might have fun doing it!

Decreasing Expenses

Finally, it never hurts to look at where you might save money.

Think about cutting cable and going with streaming services like Netflix and Amazon.

You can negotiate with your utility companies to get lower rates.

Start cooking at home more rather than eating out, and consider only buying items on sale, watching for reduced prices before spending.

This kind of thinking can really add up to hundreds of dollars each month.

In the end, anything is better than doing nothing, which will only make your bills soar higher and your stress levels shoot through the roof.

You have alternatives, you have options, and you are not alone. You may also wish to seek financial therapy, which can work to improve your relationship with money.

Find an Alternative Solution to Bankruptcy That’s Right For You

TurboFinance is here to help you decide which bankruptcy alternative is best.

With years of experience helping everyday people regain a sense of freedom and lightness that comes from paying off your bills and getting financially independent, we have built a reputation for trustworthiness amongst our clients.

We got into this business to help people just like you find the light in the darkness of what can be scary debt, and we have stayed in this business by following through with the proper resources to help time and again.

Contact us today and let’s discuss your options for debt relief that aren’t another loan or bankruptcy.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!