What Is a Credit Balance? Definitions and Examples

Posted on November 29, 2022 in Banking

In the world of banking and finance, a credit balance can mean a lot of things. A credit balance can refer to the funds you have in your checking or savings account; it can be a positive balance on your credit card or loan if you overpaid; or it can be the amount of funds owed to you in a margin account at a brokerage firm.

In general, a credit balance is a positive thing; it means the money belongs to you or is owed to you. You have been “credited” in essence.

In this article, we will discuss the last definition of a credit balance, the positive amount of money in a margin account.

What Is a Credit Balance?

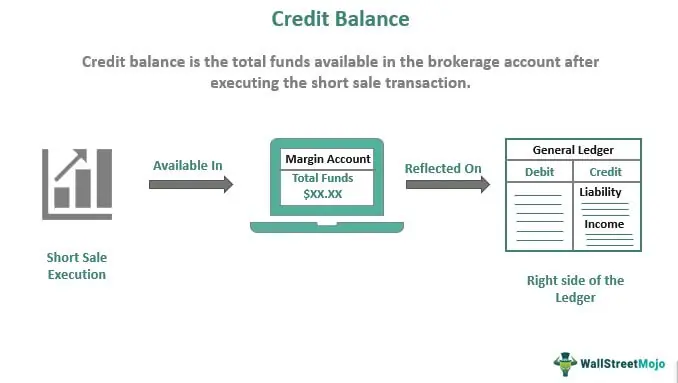

A credit balance in finance refers to the amount paid to your margin account after you make a short sale with your broker.

Now, there are a lot of terms in that definition alone, so let’s dive into each one.

Short Sale

A short sale is a transaction you, the trader, make with a broker to borrow money from your broker in order to buy and then sell securities on the stock market.

The way it works is this: you think the price of a stock is going to go up, but you don’t own the stock, and right now the stock price is down.

In order to make money, you need to buy low and sell high, but you don’t have the money to buy the stock/security right now, so your broker lends you the money so you can buy the stock, then, when you think the price is right, you can sell that stock, pay back the money you owe your broker, and pocket any excess cash you made on the sale.

All of this transaction is run through a margin account at your brokerage firm.

Margin Account

A margin account is an account you set up with your brokerage firm specifically to make short sale transactions.

You are required to establish that account with a balance of cash, typically determined by your brokerage firm.

Then, you are required to establish initial margin each time you make a short sale.

Initial Margin

Initial margin is the amount of cash you have to put up every time you make a short sale. The federal reserve requires a minimum of 50% of the total amount of borrowed securities to be in the margin account upon purchase, but your brokerage firm may require an initial margin of much higher than that.

Debit Balance

In contrast to a credit balance, a debit balance is money you owe. A debit in general finance terms is money that is taken out of your checking or savings account or charged to your credit card or loan.

You are “debited” a certain amount, and that amount is either deducted from your cash balance or it becomes a debt you owe in the form of a credit card balance.

In finance, a debit balance is the opposite of a credit balance. It is money you owe in your margin account for securities you borrowed on a short sale.

The debit balance, in essence, would be the money you owe your broker until your short sale goes through, at which point your margin account will be paid off, including the money you owe your broker and your initial margin, and you will a credit balance, the cash you can either withdraw and pocket or use for future investments, purchases, or short sales.

Cash Account

A cash account is in contrast to a margin account. It is an asset account funded fully in cash.

With a cash account, if you want to make an investment or a purchase, you will pay in full the amount owed. You would never use a cash account for a short sale as a short sale is by definition a purchase you make without having all the funds in a cash account.

A cash account is set up specifically for purchases and investments, similar to an expense account.

A margin account is set up specifically for short sales, where you buy “on margin.”

FAQs About Credit Balances

Now that a credit balance in finance has been clearly defined, let’s take a look at some frequently asked questions on this subject to help better understand the way a credit balance works and how a new trader might take advantage of a credit balance and get into short selling.

Is a Credit Balance Positive or Negative?

A credit balance in finance is neither positive nor negative. It does not reflect negatively on you as a trader or investor as plenty of people in finance make short sales and therefore have credit balances.

Neither does it “make you look good” financially to have a credit balance as it does not necessarily reflect your ability to invest or trade wisely in the market.

In terms of negative credit card balance versus debit balance, the same can be said for a debit balance, which similarly does not reflect negatively or positively on the trader.

A debit balance is merely a product of having made a short sale purchase, and a credit balance is merely a product of having made a short sale and gotten your money back plus some extra.

It’s really just numbers in an account.

What Are Examples of Credit Balance?

An example of credit balance would be if you wanted to short sale Amazon securities.

Let’s say Amazon is currently valued at $500 per share, and you suspect the share will rise very soon.

You want to buy 1000 shares, but you don’t have the $500,000 to make the purchase, so you want to short sell it.

The Fed will require you to have at least $250,000 as an initial margin in your margin account to make this short sale.

Your broker may require more, but let’s imagine the only requirement is $250,000.

You make the short sale, and now you will have a debit balance of $250,000; that’s how much you owe your brokerage firm for letting you borrow the full $500,000.

Now, let’s say in two days, Amazon stock goes up to $750 per share. Now you sell your 1000 shares, grossing you $700,000, which will be placed in your margin account, and you will have a credit balance of $200,000 after your broker is paid back the $250,000 and your initial margin is covered.

What is a Credit Balance On My Credit Card Statement?

An amount that the card issuer owes you can be seen as a credit balance on your billing statement.

With each payment you make, credits are added to your account. When you return something you purchased with a credit card, a credit might be added. Additionally, credits may be credited to your account as a result of awards you have accrued or an error in a previous statement. Your statement will display a credit balance if the sum of your credits exceeds the amount you owe. The card issuer owes you this sum of money.

Is a Credit Balance What You Owe?

A credit balance is not what you owe. A debit balance is what you owe.

A credit balance is what you can take out of the margin account in cash.

Is a Credit Balance Good?

A credit balance is good in respect of it being money you made on a short sale.

If you have a credit balance, it means you don’t owe money to your broker, and that your initial margin has been covered.

So, no matter how large or small it is, any credit balance is better than a debit balance.

Should I Make Short Sale Transactions?

Short sale transactions are tricky and highly risky, and have numerous potential effects on income taxes.

They require precise timing, and if you get your timing wrong, you could end up losing a ton of money, owing your broker, and not having a credit balance to speak of.

In general, it is only smart to make short sale transactions when you can afford to lose the money.

Let’s take the example above. The Amazon short sale is only a smart one if you are borrowing money that you can cover from other accounts that may be tied up at the moment, difficult to cash out, but accessible if absolutely necessary.

Essentially, traders are only making short sales when they have plenty of money to cover those margins, but they are hoping to not have to use their own cash in order to make those sales.

In an ideal world, your cash is tied up making a ton of money in other investments, and you get insight into a short sale that you are fairly certain will bring in solid returns.

And that certainty pays off.

In the worst-case scenario, your short sale falls through, and you lose money, but you can pay it off from other revenues.

Far too many traders have taken the risk on short sales only to end up far in debt to their brokerage firms in ways they can never recover from, or where recovery takes years.

Credit Balance Key Takeaways

In the end, a credit balance can be a great thing for trader building up their skillset with a margin account, learning to work with short sales, and taking calculated risks.

But they can also be an easy way to lose money fast, building up overconfidence after one or two successful short sales.

The best approach is to take it slowly, practice good money management, and only ever risk money you can afford to lose, credit balance or no.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!