How to Plan for Interest Rate Changes Through 2023

Posted on April 6, 2021 in Credit Cards

Disclaimer: This article was updated to reflect the Fed raising rates sooner than anticipated due to higher than expected inflation.

Table of contents

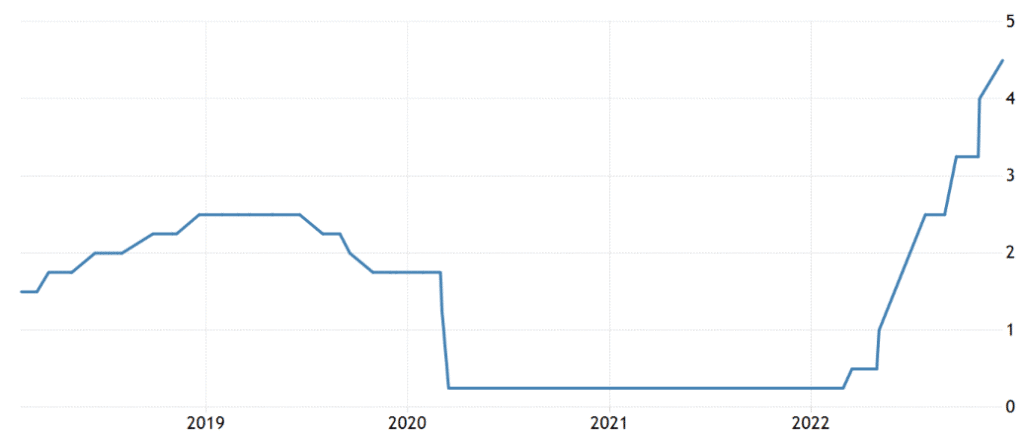

The United States had been experiencing near-historically low interest rates, and a year after the COVID-19 pandemic reached the United States, the Federal Reserve announced it would keep the benchmark interest rate near zero as the economy continues to recover from the pandemic. This dovish sentiment from the Fed changed in March of 2022, much earlier than expected, as inflation numbers began to rise to dangerous levels. This means that Americans time to refinance their debt and save money are dwindling, and it now might be worth waiting to make any changes until the rate increase continue to ease in 2023. It now seems likely that rates will begin to drop by the end of 2023, and we’ve laid out what that means for your wallet, including helpful ideas for how to plan for when interest rates come back down.

It’s an Opportune Time to Buy or Refinance a Home

While this may have been true during the near zero interest rate time period, the housing market has leveled off and in some cases come back down from it’s crazy high in the wake of the interest rate increases. Just make sure your move makes long-term financial sense for you and your family. If you are sure that you can comfortably afford a new mortgage payment, the next few years are prime time to buy a home.

Savings Rates Are Strong Again

The low interest rates were bad news for savers, but with interest rates on the rise, so are savings rates. The long-term period of interest rates means that it may be better for savers to keep cash in high-interest savings accounts or a long-term CD ladder, which provides staggered maturity dates.

Student Loan Refinancing

Currently, there is still a pause on federal student loan payments. If the debt relief program’s legality is not resolved by June 30, 2023, payments will resume 60 days later. But, when that ends, you may be tempted to jump at a student loan refinancing offer. First, you should consider what you might be giving up if you decide to pay off a federal loan with a private one. There are a number of benefits that come with federal student loans, including flexible repayment plans, deferment, refinancing, and even student loan forgiveness.

Pay Off Your Debts Before Interest Rates Rise Again

As the economy continues to improve, we will continue to see Americans borrowing more. It’s important to remember, the more debt you accrue, the more you’ll have to pay back— giving you less room in your budget. As the Fed interest rates rise, that goal may become even more important.

If you are going to use the low-interest period to pay off debt (which we strongly recommend), here’s some advice:

Prioritize Your Debt Payments

First and foremost, you need to understand which debts of yours are affected. Fixed-rate debt, like mortgage payments and some student and car loans, aren’t impacted by rising rates.

On the other hand, variable-rate debt, like credit card debt or home equity lines of credit, may see monthly payments rise with the interest rates. Take a look at the terms of your loans to find out how often your rate will adjust and whether there is a cap on how high it will rise.

Pay Off Credit Cards

Credit cards carry the highest interest rate of all loans. What’s more, they’re the most sensitive to the Federal Reserve’s interest rate changes. This means that if the interest rate hikes continue, your credit card debt may snowball out of control. This is why it’s so important to take advantage of the lower interest rates now and pay off your credit card debt. Start by committing to stop using your credit card for new purchases and pay the minimums on all credit cards. Direct any extra cash you may have each month towards your credit card account with the highest interest rate. Once you take care of that debt, move on to the account with the next-highest interest rate.

Lock in a Fixed Rate Mortgage

If you are unable to pay off mortgage debt, try refinancing it. This is a good idea for adjustable-rate mortgages and private student loans. It’s true that refinancing from a variable rate to a fixed rate might create a slightly higher payment in the short term, you will still reap the benefits when interest rates rise again, and your monthly payments stay the same.

The bottom line is that it’s important to understand where we are in the economic cycle and where we’re going so that you can take advantage of it and make the most of your money. Use the forecasts to help you find a strategy that works best for getting your debts under control.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!