Gambling Debt: How to Pay it Off

Posted on May 14, 2021 in Debt

As many as 10 million Americans are addicted to gambling, and nearly 23 million are in debt as a result of their bets. Pay off your gambling debts or get connected to the best loans for gambling debt today with our help.

- How to Pay Off Gambling Debt and Get Relief

- Acknowledge the Gambling Problem

- Stop Gambling

- Cut off Your Source of Funding

- Seek Gambling Debt Help

- Pay off Your Gambling Debt

- Bankruptcy for Gambling Debt

- Explore Repayment Options for Gambling Debt

- Smart Tips for After you’ve Paid Off your Gambling Debt

Gambling is a favorite pastime of many people around the world. Placing bets, playing games, watching sports; gambling can be exciting every once in a while. However, some people don’t just gamble for fun every so often. Instead, they develop a gambling addiction that takes on a life of its own and leaves them with a whole lot of gambling debt. Learn how to pay off gambling debt and get help through our guide below.

Gambling debt tends to grow and grow, moving from owing money to casinos to loan debt, credit card debt, and even home equity debt. The numerous large debts that come from being a gambler often lead people into bankruptcy, as they feel like they have no other options.

If you have gambling debt, don’t dive right into filing for bankruptcy. There are other options available that can help you get a hold of your gambling addiction and pay off your debt.

How many people in the U.S. have a gambling problem?

According to a study by the National Council on Problem Gambling, it is estimated that around 2 million adults in the United States meet the criteria for pathological gambling, and another 4-6 million are considered problem gamblers. The same study estimated that the annual cost associated with problem and pathological gambling, including the impact on the economy, criminal justice, and healthcare systems, is approximately $17 billion in the United States alone.

How to Pay Off Gambling Debt and Get Relief

Paying off gambling debt and ending your gambling habit is essential. Gambling can cause personal and financial devastation, including deep debt. While it may not be easy to climb out of the hole caused by your gambling, it’s a necessary step for getting your life back on track.

Learning how to get out of gambling debt will likely take a great deal of focused, intentional effort. You may need to work out a debt management plan, debt consolidation, or debt settlement, in order to start paying off your debt and building financial freedom.

If you’re wondering how to stop gambling and get out of debt, the first thing you’re going to want to do is get help for your addiction. Once you start moving forward and stop gambling, it will be easier to make the necessary moves to get yourself out of debt.

After you have freed yourself from your gambling addiction, you’ll need to focus on paying off your debts. No matter how many people and places you owe money to, the best place to start is at the very beginning. Develop a plan for paying off your debts so that you can gain control of your finances and your life.

Here’s what you need to know in order to find gambling debt relief and get out of debt for good:

Acknowledge the Gambling Problem

The first step for how to get out of gambling debt is to acknowledge the problem. If you don’t free yourself from your gambling addiction, it won’t really help to pay off your gambling debt. Even if you pay off your current debts, you’re just going to incur more if you haven’t gotten rid of your addiction.

Before you can get rid of your debts, you need to get rid of the gambling problem that caused your debts. Just like with every addiction, if you’re in debt from gambling the first step to freeing yourself from it is acknowledging that you have a problem.

Whether you have a full-blown addiction or just struggle with problem gambling, the simple fact is, if gambling is disrupting your life in some way, such as causing financial difficulties or getting in the way of your relationships, you have a problem that needs to stop.

If you have a gambling addiction, you may notice that you feel like you have a need to gamble, as well as keep it a secret. You may also find yourself gambling even when you don’t have any money. If you’re gambling with the money that you should be using for food and other necessary expenses, or you’re accumulating debt from gambling, you probably have a gambling problem.

Once you recognize that you have a gambling problem, you’re finally ready to free yourself and get rid of your debt.

Stop Gambling

It’s important that you realize you have a gambling problem and take the necessary steps to stop gambling. Many people that have gambling debt will actually accumulate more debt in their efforts to pay it off.

One of the ideas that drive gambling problems is that the person thinks they just need to try one more time in order to hit that jackpot. They gamble again and again, digging themselves deeper into debt.

In order to break your gambling problem and get yourself out of debt, you need to stop gambling altogether. Realize that paying back your debt is going to be hard work and will require a great deal of planning and sacrifice. You’re not going to win some magic amount of money that enables you to pay off your debt. Stop gambling and start working towards debt freedom.

Cut off Your Source of Funding

Don’t enable yourself to keep gambling. When you’re trying to free yourself from a compulsion like gambling, you need to remove the things that make it possible in the first place.

Close any credit cards that you’ve been using to gamble. Close your accounts on online gambling websites or apps. Have someone set passwords so you don’t have easy access to funding.

Do what you need to do to remove your ability to gamble. Slowly, the compulsion will lessen, and you’ll be ready to start paying off your debt and free yourself from being a problem gambler.

Seek Gambling Debt Help

When searching for ways how to get out of gambling debt, some people may need to have treatment for their gambling addiction. Depending on the severity of your addiction, you might want to seek help for your mental health while recovering from gambling debt. While treatment may seem like an uncomfortable option, remember that it’s important to free yourself from compulsive gambling. If your problem is too severe, there’s no shame in getting the help that you need from a professional, friend or family member.

Pay off Your Gambling Debt

After you have stopped gambling and received the help you need for your gambling addiction, it’s time to focus on paying off your debt. It won’t be easy. Paying off debt requires focused, intentional choices on how you spend your money. It takes time and can seem fruitless in the beginning. However, in order to be free of gambling debt, you need to take the plunge and keep on going.

- Make a list of your debts

Write down the various debts you owe, including the place and the amount. Make sure you get everything down so you can accurately plan.

- Decide what to repay first

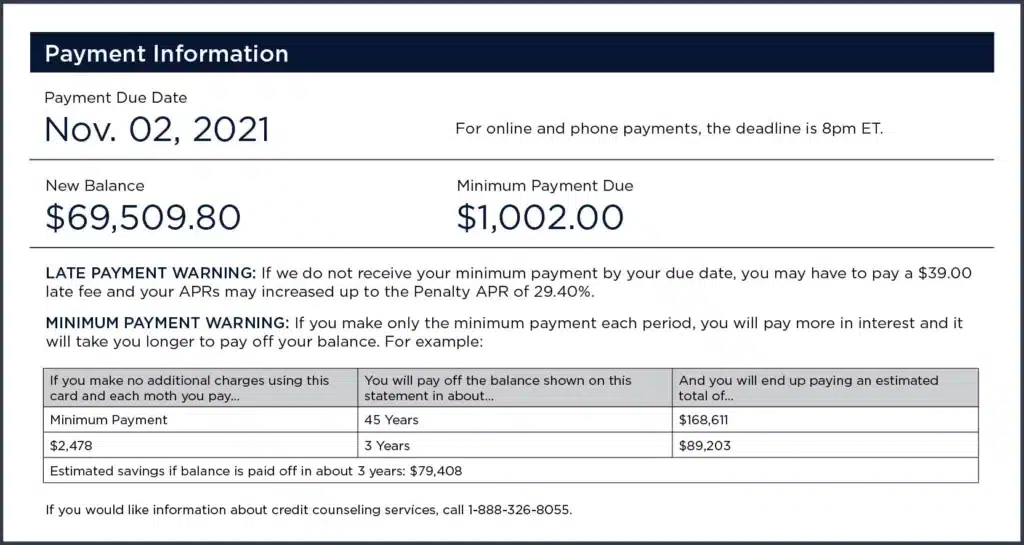

Once you have all your debts written down, you’re going to need to order your debts by importance. The debt that is the absolute, most important debt to pay will go first. If you have a debt that is soon to cause adverse circumstances for you, you’ll want to put it at the top of your list. Make sure and write down every debt on your list in order of importance so that you know where to start with repayments. A good tactic for prioritization is to pay off debt with the highest interest rate first.

- Budget

Another useful and viable option is to limit your spending each month. Create a budget that accounts for your needs such as rent/mortgage, food, gas, and bills. Minimize your excess spending so that you can focus on paying your debt.

Bankruptcy for Gambling Debt

Gambling debt can be discharged through bankruptcy. Many people have chosen to file bankruptcy as a way to relieve themselves from the burden of gambling debt. In fact, 10% of bankruptcies are from gambling debt.

While it seems like an easy way to relieve the financial burden of your debt, bankruptcy should never be your first option. In fact, filing for bankruptcy for gambling debt could just be a different burden, with the effects lasting for years. Instead of jumping at the chance to discharge your debts through bankruptcy, try other options first.

Explore Repayment Options for Gambling Debt

Once you have prioritized your debts, created a budget, and opted not to file for bankruptcy, you’re going to need to figure out how to start paying off gambling debt. The first thing you will want to do is start paying money each month on your top debt, even if it’s just a small amount. You’re going to keep on making monthly payments on this debt until it’s paid off.

If you need help paying off the debt, you can look for repayment options and gambling debt relief options. There are a handful of ways that you can obtain money in order to repay a debt. All of this will also help you improve your credit score yourself, which is another important step in achieving financial freedom.

Debt Settlement

With debt settlement you could be free from gambling debt in as little as 12-48 months. A creditor will typically agree to settle up to 50% of the gambling debt you owe through debt settlement, and if you can stick to the monthly payment plan, you may be able to get all of your debt settled faster than any other method. Furthermore, you will not be required to declare bankruptcy or take out another loan, allowing you to permanently end your debt problems.

You might be able to settle your debts by working together with your creditors, but it’s best to work with a top rated debt relief company who has a proven track record of success. If you are able to come up with a certain percentage of your debt quickly, your creditors may allow you to pay that lump sum amount in order to consider the gambling debt settled. Talk with your creditors about the pros and cons of debt settlement option to see if you can easily close your debts, or get help finding debt mediation.

Debt Consolidation

When you combine your gambling debts into one loan, you can reduce your interest rate and streamline your debt payments. Instead of having to make numerous payments each month, you’ll be able to make one simple payment that is used for the repayment of your debts. Talk with a debt consolidation company about your options for a gambling debt consolidation loan today.

Personal Loans for Gambling

You can take out a personal loan to pay off your gambling debts. Similar to debt consolidation, you’ll be able to pay off all of your debts and make just one monthly payment through gambling debt loans.

Sell Assets

Another option for repaying your debt is selling some of your more valuable assets. Electronics and cars are some of the best selling assets that could give you enough to pay your debts.

Start a Side Hustle

Increase your income while doing something you enjoy. Starting a side hustle will help you increase your income. You may also have family or friends that want to help you get free from your gambling problem and get out of debt. They may be willing to loan you money, provided it goes straight to debt repayment.

The bottom line is, there are many options available that will help you pay off your debt. If you’re serious about financial freedom, take the time to research these options and decide which is best for your situation.

Smart Tips for After you’ve Paid Off your Gambling Debt

You’ve finally paid off your gambling debt. You’ve broken free from gambling addiction and found relief. You’re going to want to make sure you don’t fall back into either one. Here are some tips for keeping yourself free from gambling and free from debt:

- Don’t gamble

- Keep expenses low

- Have someone help you monitor your bank account

- Create a budget

- Build an emergency fund

- Seek support

- Find new hobbies

- Monitor your credit score

- Celebrate your success

With a lot of work and a lot of determination, you can break free from gambling debt.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!