Can A Payday Loan Company Garnish My Wages?

Posted on June 7, 2022 in Loans

A payday lender can garnish your wages only if it has a court order based on a lawsuit filed against you. Learn more about how payday loans can garnish your wages, and what steps you should take if you can’t manage your payday loans any longer.

Table of contents

- What Happens If You Don’t Pay? How Can A Payday Lender Garnish Your Wages For A Payday Loan

- What Is Wage Garnishment & How Does It Work?

- How Much Can A Payday Loan Company Deduct From Your Wages?

- FAQ’s About Payday Loan Wage Garnishment

- What if you can no longer manage your payday loans and are afraid of wage garnishment?

What Happens If You Don’t Pay? How Can A Payday Lender Garnish Your Wages For A Payday Loan

If you fail to repay your loan, the payday lender or a debt collector may sue you in order to collect. If they win, or if you fail to contest the lawsuit or claim, the court will issue an order or judgment against you. The amount of money you owe will be stated in the order or judgment. A wage garnishment order can then be obtained against you by the lender or collector.

What Is Wage Garnishment & How Does It Work?

Wage garnishment occurs when your employer withholds a legally required portion of your wages to pay off your debts. Bank garnishment occurs when a garnishment order is served on your bank or credit union. As permitted by state law, the bank or credit union then holds an amount for the payday lender or collector. Each state will have its own procedures and exemptions from garnishment that apply to both wage and bank garnishment. Certain benefits or payments, for example, are generally exempt from garnishment under federal law.

How Much Can A Payday Loan Company Deduct From Your Wages?

The amount of pay subject to garnishment is determined by an employee’s “disposable earnings,” which are the earnings remaining after legally required deductions. Federal, state, and local taxes, as well as the employee’s share of Social Security, Medicare, and State Unemployment Insurance tax, are examples of such deductions. It also includes mandatory withholdings for employee retirement systems.

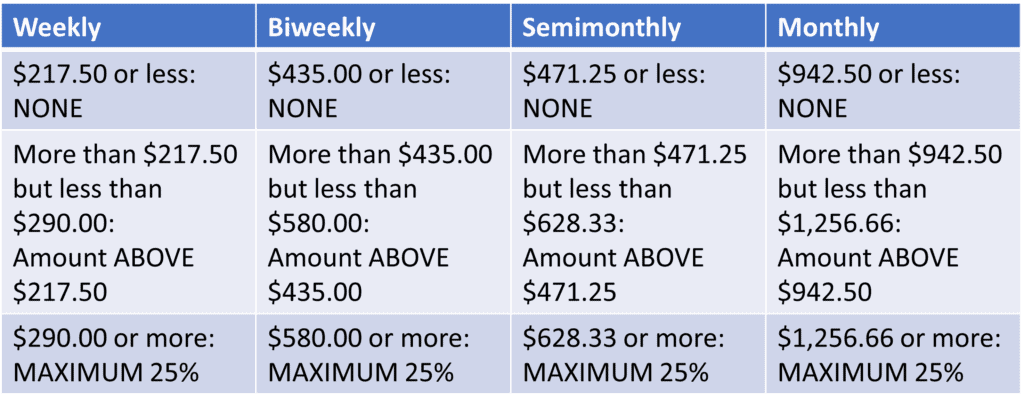

The lesser of two figures below is the maximum amount that can be garnished under Title III of the Consumer Credit Protection Act.

- 25% of the employee’s discretionary earnings

- The amount by which an employee’s weekly disposable earnings exceed 30 times the federal minimum wage.

For more information, and specific examples of the maximum payday loan wage garnishment of disposal earnings, please see the U.S. Department of Labor fact sheet.

FAQ’s About Payday Loan Wage Garnishment

What happens if payday loan goes to collections?

Court summons: Even if you only owe a small amount of money, a collection agency may summon you to court. Depending on where you live, this could result in liens on your property or even wage garnishment. It’s also important to remember that there is no government help with payday loans, so you’ll need to go through the court summons process on your own or with other assistance.

Can payday loans harass me at work?

Your payday lender cannot perform excessive collection calls or harass you repeatedly under US law. The lending company cannot threaten to increase your debt beyond the agreed-upon interest rate. The payday loan company also can’t threaten you with jail or call you outside of business hours. Remember, you can’t go to jail for unpaid payday loans.

What happens if I close my bank account and default on a payday loan?

You will be contacted by debt collectors.

If you close your account or remove your payday lender’s access, they will waste no time in attempting to recover their funds. They will almost certainly turn over your loan to a collection agency. Expect to be contacted through a variety of channels in an attempt to withdraw money from your bank account.

What if you can no longer manage your payday loans and are afraid of wage garnishment?

If you’re no longer able to manage your payday loan agreement and need to know how to legally stop a lender from debiting your account, you may be ready for one of several proven debt relief options. When it comes to unsecured debt, one size rarely fits all, and having options is critical in debt management. TurboDebt, which has over 3,000 5-star Google reviews and an Excellent rating on Trustpilot, connects clients to alternatives to loans or bankruptcy that meet their specific needs.

Related blog posts

Need expert financial advice?

Let TurboFinance connect you with the best consulting services and resources to help you take control of your finances and find a path to build wealth.

Get A Free Consultation Today!